|

Tools:

The Changing Face of GamingThe world of video games is about to change - fundamentally

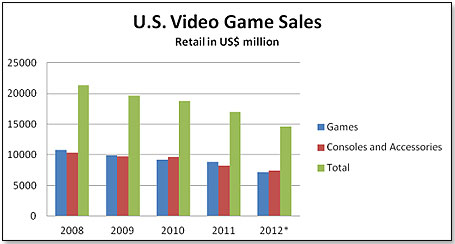

Video game retail sales in the U.S. have been plunging since 2008, which would suggest that the industry is in the continuing throes of very significant and probably structural changes. Sales of games, hardware and accessories combined have dropped from $21 billion in 2008 to an estimated $14.6 billion in 2012. Games alone dropped from $10.8 billion in 2008 to an estimated $7.2 billion this year:

Source 2008 to 2011 data NPD, 2012 data Klosters Retailer Panel

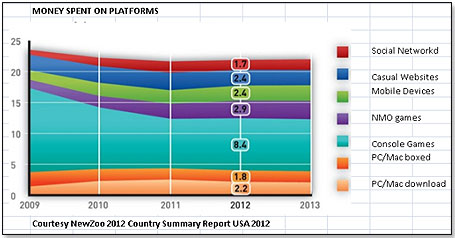

While industry insiders suggest that this all is simply due to the fact that new consoles are coming down the pike and that consumers are waiting for them, I think what has really happened is that gamers have moved from buying at retail to getting their games digitally. Also, they moved from consoles to other devices such as computers, smart phones and tablets. If these movements are factored into the equation this is how the total U.S. market place for video games actually developed:

In other words, rather than declining, the total amount of money spent on video games did not drop at all in the last twelve months and is estimated at $21.9 billion for 2012. This means that retailers now only represent about two-thirds of the total U.S. video game software universe, and that the remainder is bought digitally. According to the UK Entertainment Retailers Association, the picture in the U.K. is worse – boxed sales in 2012 stood at £1.05 billion, or down 26%. Online sales of video games grew by 7.7% to £552.2 million. As a result, physical sales accounted for 65.4 per cent of the 2012 video games market – which is down from 73.5 per cent the year before.

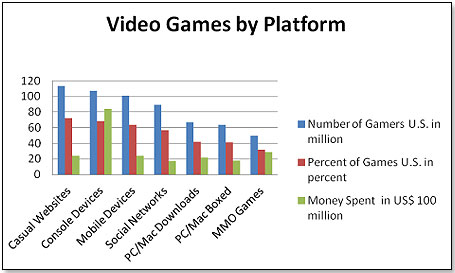

When considering these numbers, the split between boxed and downloaded PC/Mac games is odd and surprising. Downloaded games for computers exceed those bought in boxed form from retail at a 55:45 ratio, which is much higher than for any other platform. This is also clear when looking at the various platforms:

Source NewZoo 2012 Country Summary Report USA 2012

Why would the U.S. video gamester prefer the downloaded PC/Mac games to the boxed version to this striking extent? Could it possibly be that they were finally given an alternative that provided the convenience and satisfaction that they had been demanding for years?

Ever since the first video games made their appearance, consumers have chafed at the restrictions imposed on them. They had to wait in line to buy the consoles from a retailer, they had to go to the store to buy the games, and they had to struggle their way through often extremely complicated installation hoops. And ever since the first game arrived on the scene, computer wizards have tried to overcome these obstacles.

The Holy Grail was to provide a service that would allow users to play these games not only on the specified consoles but also on the PC or Mac available in virtually every home. The games had to be accessible online, thus eliminating the trek to the nearest GameStop. And the provider of the service had to be ready and happy to automatically deliver all the patches, updates, fixes and whatever else that up to that point had been the bane of the consumers’ existence. And, they had to offer all this at an affordable price.

Four got to the finish line – Steam, EA’s Origin, Gaikai and Onlive.

The first was Steam.

Steam is the brainchild of Valve Corporation, a video game development and digital distribution company. Valve was founded in 1996 by two former Microsoft execs, Gabe Newell and Mike Harrington (Mike left shortly afterwards). In February 2002, Valve launched Steam after about three years’ development as a digital distribution, multiplayer and communications platform, allowing consumers to access game titles from both small independents as well as such powerhouses as Activision and Ubisoft. Consumers can play Steam games on either their PC or Mac and now also, since September 2012, on the TV screen.

Steam is a Godsend for the publishers in that they can sell directly to the consumer and cut out the retailer margin of about 20%, which means that their income jumps by half. They also remove the title from the “used game” market, which directly competes with their new games. Finally, they also eliminate the copycats who illegally replicate up to 20% of all games sold at retail in the United States.

There is little question that this worked for Steam and for the publishers offering their wares via the site. Steam is currently available in 237 countries and in 21 different languages. In December 2012 Steam offered nearly 1900 games and there are over 54 million active user accounts worldwide. The highest concurrent peak of users on the site was 6 million gamers on November 25, 2012.

The company is currently estimated to have over half of the worldwide downloaded game market on PCs and Macs. This market is estimated at $20 billion by DFC Intelligence. Assuming a similar split of 55:45 between downloaded and boxed PC games, the result is would give Steam-provided games a 2012 sales result of at least $5.5 billion. This appears to be an incredibly high number. However, given Bethesda’s news bulletin dated December 16, 2012, that their new Skyrim game had in the preceding 30 days via Steam sold 10 million units worldwide or the equivalent of $650 million, the $5.5 billion figure does not seem to be that outlandish anymore.

Now, of course, Steam does not pocket the $5.5 billion, but they are likely to have a commission of somewhere between 5% and 15% from the top which is the norm in the industry. Given this, their 2012 top line should be in the neighborhood of $500 million. And this by a company that started a mere ten years ago and which totally funded its start-up needs and subsequent growth from its own resources and did not go begging for money from outsiders.

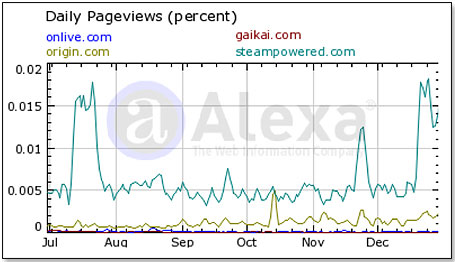

As I said above, the first to reach the finish line was Steam but there were two other later contenders. One was Gaikai, the other OnLive. A record of consumer web visitations best illustrates the relative importance of these two competitors:

Source Alexa Internet

Since web visits are a very important metric for cloud-based services, this chart gives a fairly clear view of the relative importance of the four companies involved.

Origin

Origin is the brainchild of Electronic Arts, the noted publisher of video games. In the seven years of its existence, the service went through a number of changes – name changes, changes in the service offered, and changes in the platforms suitable for it. It was launched in 2005 as E.A. Downloader, then was replaced by E.A. Link in late 2006 and began to include demos and other special content. E.A. Link was again restructured in September 2007 by a combination of the EA Store and the EA Download Manager. The way this worked was that you bought your games from the EA Store and then used the Download Manager to transport the bought games to your PC. Finally, in June 2011, the two services were combined into one under the name of Origin.

While Origin is clearly a better service than its earlier versions, it still has very significant problems, particularly in the area of downloads. EA is working on them and promises to have them resolved quickly. On July 18, 2012, EA's Origin chief David DeMartini acknowledged that some core gamers have "issues" with the digital download service. "People forget that when Steam launched, there was a lot of backlash from the core," he said. "Origin represents a change, and anytime EA does something that is significant in the industry, it generates a certain amount of reaction.”

By early 2012, Origin had 9.3 million subscribers – a figure which is thought to have risen to nearly 10 million by end of 2012. There is no data on concurrent usage.

This is what Blake J. Jorgensen, EA’s CFO, said about the service in their earnings call of October 30, 2012:

“A quick update on Origin. We now have over 30 million registered users, including 13 million mobile gamers to date, and revenue was up sharply year-over-year off a small base. Additionally, we have signed agreements with over 70 independent developers to publish their games on our platform, along with our own vast catalog of titles and new launches.”

In the same earnings call, he added that on 10/30/2012 4.4 million people had actually purchased Origin up to that point at an average of $64 per person. This equals a total sales number of $281 million, about one-third of which were generated in 2012.

In summary, if there is one company that has a real shot at challenging Steam it is undoubtedly Origin. However, they clearly still have a way to go as demonstrated by their number of active users, 4.4 million, versus Steam’s 54 million users and their estimated 2012 sales result of $94 million versus Steam’s $500 million number for the same period.

Gaikai was founded in November 2008 as a cloud-based gaming service using high-end PCs as a platform. They entered into two agreements in 2012 to extend their reach into television – first with LG Electronics and then with Samsung for their 3D and Smart Television sets. Gaikai was bought by Sony in August 2012 for $380 million and the industry has been asking “why” ever since. One theory is that Sony bought Gaikai – because they could not buy Steam – to basically shut up a competitor who could adversely affect the fortunes of its next-generation console, the PS 4.

The official version is that Sony took this decision “because they wanted to establish their own new cloud-based gaming service.” While this may be the case, there have been no further pronouncements from the side of Sony since then and no obvious developments in that direction either.

OnLive came later, in March 2009. OnLive was founded in 2002 by Steve Perlman, former Microsoft Division President and Apple Principal Scientist. Firstly, he spent over seven years developing the technology before finally going public with it. Secondly, he vastly overstaffed and also entered into incredibly large capacity agreements, which led to the company burning through $5 million cash each month.

As an example, they had deployed thousands of servers that were sitting there unused since it appears that the highest concurrent user number ever was 1600 worldwide. This compares with Steam’s 6 million. Not so surprisingly, the company never made money.

As could be expected, OnLive very shortly began to need cash and thus made a deal in 2009 with the Belgacom Group, the largest telecommunications company in Belgium, and then later that year with British Telecommunications Group PLC, one of the largest telecommunications services companies in the world. Both companies injected about $30 million each into the company. While this helped, it was not enough and OnLive had to make yet another deal early in 2011 with HTC Corporation, a Taiwanese consumer electronics giant, who injected another $40 million.

Things went from pretty bad to much worse in a hurry. OnLive finally ran out of money middle of 2012 with no new donor on the horizon. So they went belly-up and closed shop on August 17, 2012. Steve then immediately turned around and founded a new company, which he called – you guessed it – OnLive! On August 20, 2012, the new OnLive was sold to Gary Lauder. Gary Lauder is the Managing Partner of Lauder Partners LLC, a Silicon Valley-based venture capital firm investing primarily in information technologies. It is said that Gary bought OnLive with all its patents and other assets for $4.8 million.

All three former investors – HTC, Belgacom and British Telecommunications – wrote off their investments in OnLive, totalling about $100 million. Steve Perlman was ousted from the new OnLive Company on August 27, 2012. Since then, it appears that he has started up a new company called “Strike a Pose”. Nothing material has been heard of the new OnLive Company since then either.

So - Steam has basically conquered the PC-based cloud-gaming market. However, with a market share such as this, and in the absence of meaningful growth in the PC gaming segment, future growth will prove very elusive unless the top people at the company can think of something new. And it appears that they are doing so.

Reports have it that they have developed their own Linux-based gaming console that will be released just before the next-generation gizmos of Sony and Microsoft hit the market place. While it is assumed that this Steam console will go head-to-head with the new Xbox and the new Play Station, both expected to be released for the 2013 Holidays, nothing is so far known about the configuration of the device or its price.

However, the top people at Steam – and specifically Gabe Newell, their head honcho – have shown that they know what they are doing, and I would assume that this characteristic will continue to also apply to the development and marketing decisions for this new console.

Writer's Bio: Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author

THIS BANNER IS AN AD:

• • • • • • • • • • • • • | • • • • • • • • • • • • |

Back to TDmonthly's front page

|  |

Advertise on TDmonthly

|