|

Tools:

The Video Game Market – Winners and Losers

| “I think that GameStop’s used game engine will begin to grind to a halt next year as more and more software developers switch to on-line delivery.” — Rob Enderle, Principal Analyst at the Enderle Group |

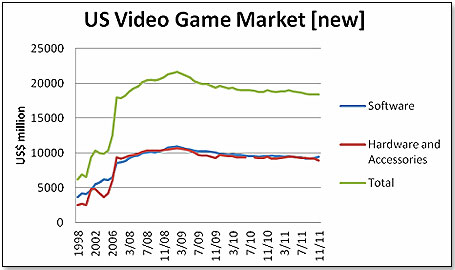

The U.S. video game market continues to disappoint– at least, if you rely on NPD numbers only and look at the brick-and-mortar channel in isolation. This is how these particular retail sales stack up:

NPD does not measure two key components of the U.S. video game market – used games and digital sales. The former is important in that it represents a highly lucrative segment, one that basically keeps GameStop, the largest video-game only retailer in the United States, in business. The second is even more important, especially in the long run, as it represents the shape of the future.

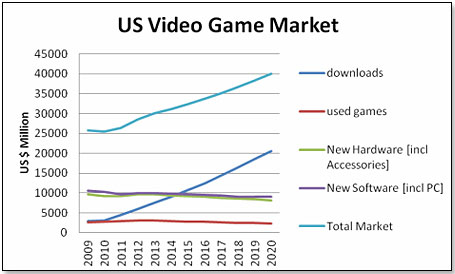

All indications are that future growth in video games will be driven by online. The national buyers I spoke to agree that all major segments of the video game marketplace will be affected by this to a major degree – from new hardware and accessories to all packaged software, whether new or pre-used. This is how the development is likely to play out:

There is a slight bump in the 2012 and 2013 time frame caused by the likely introduction of the next generation of consoles – the Xbox 720, the PS 4 and the WII U – and this in turn will in the same two years cause an uptick in software sales. However, as the chart above illustrates, the longer-term trend is very clear – down.

The participants in this market place fall into two categories – those that will benefit from the trend and those that will go to the wall. The former are all those software publishers who manage to ride the digital tiger. The latter, the losers, are clearly the manufacturers of consoles – Microsoft, Nintendo and Sony - who have been locked out of the online MMORPG business all along and who will in all probability have equally no role to play in a universe dominated by online or cloud gaming.

There is one entity where the jury is still out – GameStop. This retailer has today two very major selling propositions – its thousands of brick-and-mortar stores, and the very savvy and experienced people behind its counters. Both will be redundant in an online world and the question is whether GameStop can make the transition from being a retail store on Main Street to being a digital provider of services. There is one entity where the jury is still out – GameStop. This retailer has today two very major selling propositions – its thousands of brick-and-mortar stores, and the very savvy and experienced people behind its counters. Both will be redundant in an online world and the question is whether GameStop can make the transition from being a retail store on Main Street to being a digital provider of services.

Until recently, the major factor in downloads were the PC and Mac-based MMORPGs – a genre of role-playing video games in which a very large number of players interact with one another within a virtual game world acted out on PCs or Macs. Arguably the most successful game in this category is World of Warcraft by Blizzard, which as of today has an estimated 10 million subscribers. However, that number is down from the peak of 12 million late 2010 and the decline appears to be continuing. This flies in the face of all data, which tell us that the online business is growing. Growing it is but also, at the same time, it is changing and moving away from MMORPGs towards individual games.

What was the spark that brought about this change? It was unquestionably Apple, with its iPhone and iPad. While they were not originally conceived as gaming platforms, this is what they have become. And in so doing, they unleashed a young, energetic and innovative group of game developers who had given up on the established publishers and who enthusiastically embraced the promise of these breakthrough products.

And breakthroughs they are. There are today 50 million iPhones in use in the United States and this will reach 90 million next year. Of these, no less than one-third is used for gaming, and the percentage keeps on growing. The iPad is even more impressive. Nine million have been snapped up since the table was introduced last year and this is expected to reach 25 million next year. 71% of these tablets are now used for gaming and this percentage is likely to grow as well.

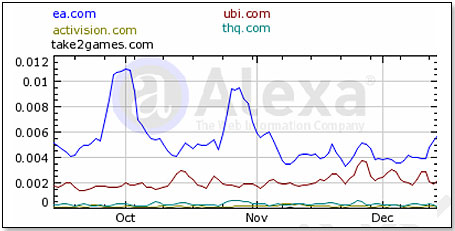

All major software publishers are scrambling to get on this bandwagon but so far, only one is getting traction – Electronic Arts. They recently bought three of these enthusiastic game developers – PopCap, Chillingo and Clickgamer. The company now has three of the top ten paid iPhone games and one of the top ten paid iPad games in the U.S., and exactly the same in the UK. A few days ago, Der Spiegel, Germany's leading weekly, rated the best board games on the iPad. EA, as the only U.S. company, had three out of twelve - Trivial Pursuit, the Game of Life, and Monopoly.

The company is in the process of creating an online presence that relies for its growth not on MMORPGs, but rather individual games played over a variety of channels, which the company expects will grow to $1 billion, or about 25%, of its total sales. In this context, Electronic Arts just released The Sims as a free app for the iPhone, the iPad and the iPod. The game has sold more than 150 million copies worldwide since inception in 2000. The company is in the process of creating an online presence that relies for its growth not on MMORPGs, but rather individual games played over a variety of channels, which the company expects will grow to $1 billion, or about 25%, of its total sales. In this context, Electronic Arts just released The Sims as a free app for the iPhone, the iPad and the iPod. The game has sold more than 150 million copies worldwide since inception in 2000.

In contrast, Activision with its MMORPG stake has 38% of its sales online, but appears to be in the wrong neighborhood with its mainly PC-based business. This may change – they are looking at the iPad as a platform but appear stymied by the fact that World of Warcraft is designed for use of a mouse and a keyboard and they have not so far seen a console solution that lets them replicate this easily. Greg Street, lead systems designer, indicated that they would also want to own a lot more of the back-end than most console companies would be willing to let them have. In other words, it is doable but not yet practicable.

The other publishers – THQ, TakeTwo and Ubisoft – are equally determined to get onto the digital bandwagon and are making efforts to develop games to suit the iPad and iPhone model. Ubisoft bought online game developer Owlient in July this year in order to strengthen its digital business. Owlient had 2 million online subscribers at that time. Survival of these three publishers will very much depend on the speed and extent by which they can harness the promise of tablets and cell phones as gaming platforms, and the jury is still very much out on this. Looking at web traffic numbers suggests that the only two that really are getting traction are Electronic Arts and Ubisoft:

Another factor in the online equation for video games is the increasing weight of Onlive. Onlive began in 2008 with the mission of providing console games digitally to PCs. In this they pretty much succeeded and they now have nearly 200 games in their portfolio. They have just announced plans to bring these games not only to PCs but also to tablets and cell phones, and they are widely predicted to become an increasingly important factor in the video game delivery world.

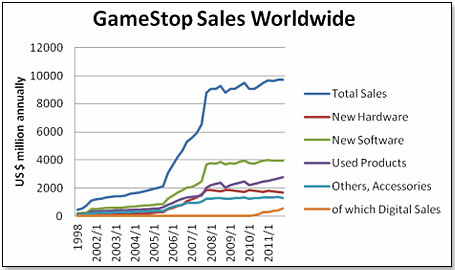

The question is where this all leaves GameStop, the largest video game retailer in the United States with more than 6000 stores worldwide. This is how their business developed over the past years:

Today, for the vast majority of its sales and gross profit GameStop relies on its stores, and only for 5% on digital delivery [estimated numbers are for fiscal year ending January 29, 2012]:

| Products |

Sales $ mio |

% of Total |

Gross Margin$ mio |

% of Total |

| New Hardware and Accessories sold in stores |

2983 |

30.7 |

369 |

14.5 |

| New Software sold in stores |

3441 |

35.5 |

690 |

27.1 |

| Used games and hardware sold in stores |

2756 |

28.4 |

1378 |

54.1 |

| Total sold in stores |

9180 |

94.6 |

2437 |

95.7 |

| Software sold digitally |

520 |

5.4 |

110 |

4.3 |

| Grand Total |

9700 |

100.0 |

2547 |

100.0 |

If the trend towards online continues as predicted, not only will GameStop’s business in new hardware and software begin to suffer; their used game business will be equally vulnerable.

This is what Rob Enderle, Principal Analyst at the Enderle Group, told me:

“In general I think that GameStop’s used game engine will begin to grind to a halt next year as more and more software developers switch to on-line delivery and the service that OnLive represents becomes better known and more powerful. Currently up to 90 of a game’s user base may be made up of pirated copies, which has been killing the game companies’ revenue model. Something has to change, and will, in order for these companies to survive. App stores and services-based offerings coupled with malware infected side loaded risk provide the opportunity to eliminate, or at least reduce catastrophically, on-line piracy and this future moves sharply away from GameStop’s model. If the market can rapidly make the switch over to these new delivery methods, and if the buyers stay with the platforms, (both big ifs) it could forestall the failure of game companies like THQ and Take Two.”

GameStop is making tremendous efforts to move their business online in order to accelerate growth overall and to compensate for the now vulnerable brick and mortar business and profits that are predicted to decline as of next year. They have now something like 5% in the digital category and they could indeed multiply this number. However, they find themselves in a Catch-22 situation. If they do not succeed, their business will greatly diminish over time and they will have to close a major percentage of their 6,600 stores worldwide – stores which now are the major reason why consumers buy their video games from them, as opposed to Walmart or ToysRUs. If they do succeed, they are in exactly the same quandary. Their brick-and-mortar business will diminish and they will have to close stores, too. GameStop is making tremendous efforts to move their business online in order to accelerate growth overall and to compensate for the now vulnerable brick and mortar business and profits that are predicted to decline as of next year. They have now something like 5% in the digital category and they could indeed multiply this number. However, they find themselves in a Catch-22 situation. If they do not succeed, their business will greatly diminish over time and they will have to close a major percentage of their 6,600 stores worldwide – stores which now are the major reason why consumers buy their video games from them, as opposed to Walmart or ToysRUs. If they do succeed, they are in exactly the same quandary. Their brick-and-mortar business will diminish and they will have to close stores, too.

Writer's Bio: Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author

THIS BANNER IS AN AD:

• • • • • • • • • • • • • • • • • | • • • • • • • • • • • • • • • • |

Back to TDmonthly's front page

|  |

Advertise on TDmonthly

|