|

Tools:

The Shrinking Toy SpaceWalMart, Target, and ToysRUs Focus on Online Sales

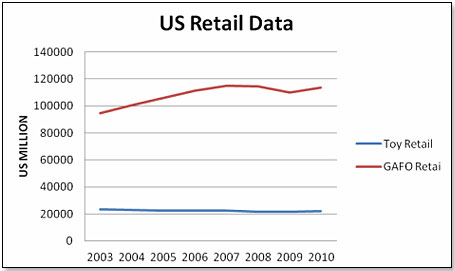

There are increasing indications that U.S. retail, particularly the super store chains [Wal-Mart, Target, and ToysRUs], are engaged in an ongoing process designed to reduce the retail space devoted to toys. The reason for this is simple. Their management looks at the products they are selling and see that toys are, in dollar terms, as flat as a pancake in comparison to the overall retail business as defined by GAFO [which stands for General Merchandise, Apparel and Accessories, Furniture and Other Sales]: There are increasing indications that U.S. retail, particularly the super store chains [Wal-Mart, Target, and ToysRUs], are engaged in an ongoing process designed to reduce the retail space devoted to toys. The reason for this is simple. Their management looks at the products they are selling and see that toys are, in dollar terms, as flat as a pancake in comparison to the overall retail business as defined by GAFO [which stands for General Merchandise, Apparel and Accessories, Furniture and Other Sales]:

Note: The GAFO numbers were reduced by 90% to make a comparison visible. – Source JRDeLisle

In addition, if you consider the rapidly increasing online portion of toy sales, accounting for about 15% of the total in 2010, the brick-and-mortar growth rate is turning negative at an increasing clip.

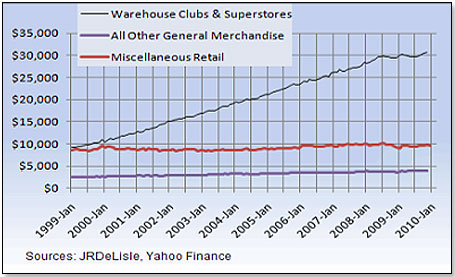

They also look at the overall trend line as it applies to their store category, which is Superstores:

What these curves are not telling you is that there are, within these averages, product categories that outshine the others. Food, for instance, increased by 43% between 2000 and 2009. Health and Personal Care did even better, doubling in the same time span. Compare this to toy’s performance – down 5% between 2000 and 2010 and, if you back out online sales, down 20%.

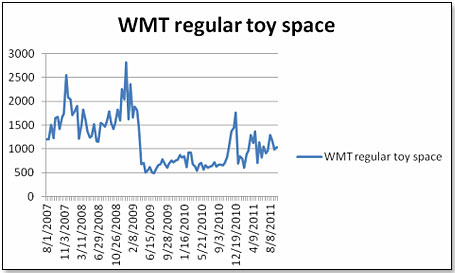

The first to do something about it was Wal-Mart. They called it “Project Impact” and proclaimed it as a way of making the store nicer to shop in – wider aisles, less clutter, pastel colors – all in the hopes of increasing store traffic. They slashed the toy department space by more than half in the process. Mr. W. Simon, their newly minted CEO, pointed out to his troops in August last year that Project Impact had not really worked. Not only did the store continue to lose consumer traffic, they also lost market share, particularly in the toy space. Mr. William gave the mandate to his troops to double the toy space for the fourth quarter – with very questionable results.

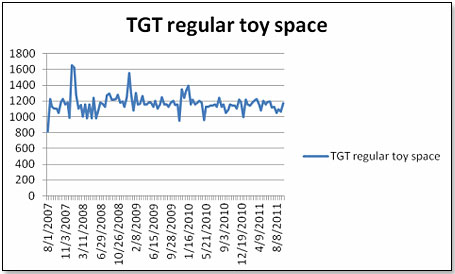

This is how their toy space developed over time:

The sharp drop-off early 2009 was the result of Project Impact. The second peak in 2010 reflects the doubling-up of the toy space. Since then, we have seen first a marked drop-off in January, then a gradual expansion, which has basically flattened out in the past six months. I understand that this will be the shape of things to come until end of the year, when you can again expect a sharp decline.

The unprecedented expansion of the toy space in the fourth quarter last year was an unmitigated, disaster and is hence very unlikely to be repeated. The entire thing was badly planned and badly executed. Since the buyers were given very short notice to find additional merchandise to fill these shelves, and since very few of their regular suppliers had enough additional merchandise at hand to satisfy the enormous amount of product this entailed, they had to search high and low to find something, anything, to put on the shelves. This meant that they had to accept products they would not, under normal circumstances, have touched with a ten foot pole. The final outcome was that Wal-Mart’s toy department increased inventory levels by 100%, gained 1% market share in a flat market, and ended up with an incredible inventory overhang at the end of the year. As I said, this is not likely to be repeated this year or at anytime in the near future.

ToysRUs appears to be engaged in a similar endeavor. Their position is more difficult in that, as their name says, their business is primarily toys. But is it? Last year it most certainly seemed to be so, as they opened in addition to their regular stores another 600 Pop-Up or Express stores exclusively devoted to toys. However, when you analyze their store breakdown, you get to two-thirds toys and one-third BabiesRUs products. ToysRUs appears to be engaged in a similar endeavor. Their position is more difficult in that, as their name says, their business is primarily toys. But is it? Last year it most certainly seemed to be so, as they opened in addition to their regular stores another 600 Pop-Up or Express stores exclusively devoted to toys. However, when you analyze their store breakdown, you get to two-thirds toys and one-third BabiesRUs products.

This year, that percentage is going to change for two reasons. One is that they intend to open considerably less Pop-Up stores – at most 300, half of last year’s number. Secondly, a number of their stores are undergoing a reset which greatly increases the percentage of BabiesRUs products over toys. In one specific store, this reset decreased the toy percentage from 68% to 45% and increased the Babies percentage from 22% to 45%. The square footage devoted to Video Games and Electronics remained unchanged.

Why would they do something like this? The answer is simple. There are more than four million babies born each year in the United States. And, ironically, ToysRUs is in a much stronger position in the baby market than in the traditional toy market. In addition, competition in the baby market is much less concentrated, and margins therefore tend to be better. But most important is the fact that we look at a growing market as opposed to a stagnant or even declining one.

While management at TRU states unequivocally that they do not intent to curtail the space devoted to toys, and while I fully believe that they are simply telling what they perceive as the truth, the underlying dynamics of the market place will, over time, not leave them many choices in the matter. And there are too many straws in the wind that suggest that a rethinking is in fact already under way.

In the case of Target we see a store that has kept its toy space pretty consistent over the years regardless of good times or bad. Even their yearly marginal Christmas season peak disappeared last year :

Target management knows perfectly well that the toy market is stagnant or declining and they know that there are more promising categories – e.g. food. Earlier this year, Target rolled out its food test exercise in all its stores and revamped the entire store lay-out to make it more appealing to consumers. Somewhat to my surprise, they left the toy space pretty much alone. That does not mean that they are not thinking of how to make their square footage yield more growth and more sales – they just appear to go about it more carefully.

From my contacts in the industry I understand that one strategy being discussed in the top management offices in Minneapolis-St.Paul is pushing toy sales to online – similar to the model followed by GameStop. Target is looking enviously at ToysRUs’ online sales and growth last year - $782 million, up 30%, representing 10% of their total U.S. Sales. They also look at Amazon whose toy sales, all online, now represent 6% of the total toy market in the U.S. – well over a billion dollars. Equally interesting is that the online portion of the total toy market in the U.S. grew last year by an astounding 22%, becoming an estimated 15% of the toy market. From my contacts in the industry I understand that one strategy being discussed in the top management offices in Minneapolis-St.Paul is pushing toy sales to online – similar to the model followed by GameStop. Target is looking enviously at ToysRUs’ online sales and growth last year - $782 million, up 30%, representing 10% of their total U.S. Sales. They also look at Amazon whose toy sales, all online, now represent 6% of the total toy market in the U.S. – well over a billion dollars. Equally interesting is that the online portion of the total toy market in the U.S. grew last year by an astounding 22%, becoming an estimated 15% of the toy market.

To make their online push as successful as possible, they appear to have embarked on a three-pronged strategy:

Revamp their website to make it more user friendly

Terminate the relationship with Amazon so as to remove competitive and other conflicts.

Drive as much toy sales to the website by offering web-only specials.

As for the third, their web specials for toys in September amounted to an astonishing 700 offers of which more than eighty were sold out totally.

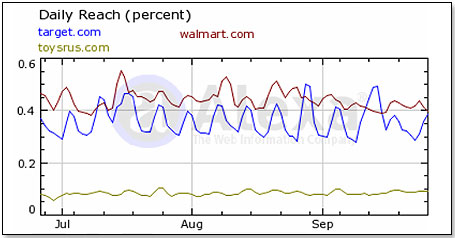

Is their web strategy working? The only guide is measuring their web traffic overall which has shown a significant trend upwards:

In the past three months, Target’s web traffic increased by 21.9%, compared to Amazon’s 3.4% and TRU’s 17.6%.

So where is all this leading? If Target manages to shift a substantial portion of their toy sales to the web, they will be able to cut back on their toy space and devote the free square footage to more promising endeavors. This is clearly a long-term endeavor, and nothing of any import is going to happen this year.

I think that this strategy would be the most intelligent of them all, because it does not run the risk of losing sales, offending consumers, and inflicting pain on vendors. Also, because it is a logical and farsighted strategy, it is likely to succeed.

In summary, is the toy space going to shrink? Most certainly, in my opinion. Are toy sales going to suffer as a result? I think not. In fact, I think two trends will emerge over the next couple of years. One is that the flattening of the toy sales curve due to demographic and pricing factors has pretty much run its course and population growth will begin to turn the curve positive in the next couple of years. The other likely trend is that the online toy business will more than make up for a decline in mass retail brick-and-mortar sales. Who knows, we may even see the return of the small specialty store; but this may be too much to ask.

Writer's Bio: Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author

THIS BANNER IS AN AD:

• • • • • • • • • • • • • • • • • • • | • • • • • • • • • • • • • • • • • • |

Back to TDmonthly's front page

|  |

Advertise on TDmonthly

|