|

Tools:

Which Movie-Themed Toys Will Rock 4QBox-Office Success Doesn’t Translate to Toys

Lutz Muller is an industry analyst who shares opinions and makes market projections based on public and confidential research, including interviews with contacts at major U.S. retailers.

You could not imagine the toy department in any major retailer without LEGO Star Wars, Iron Man action figures, Hannah Montana fashion dolls, Toy Story 3 Barbies, and the GI Joe Battleship board game. Movie-backed toys represent about 10% of total toy sales in the United States.

The extent to which a film succeeds in generating toy sales hinges on several key factors: Box office results, audience demographics, product execution, good price points and placement with the major retailers.

I picked five films for this analysis – Transformers 2 and Iron Man 2, both classical action figures themes focused on boys; Alice in Wonderland — tailored to fashion dolls and girls, Avatar — which I see as a family-oriented film with a clear action-figure overlay, and Toy Story 3, which is oriented towards preschool. The first two were distributed by Hasbro whereas the latter three were handled by Mattel. I picked five films for this analysis – Transformers 2 and Iron Man 2, both classical action figures themes focused on boys; Alice in Wonderland — tailored to fashion dolls and girls, Avatar — which I see as a family-oriented film with a clear action-figure overlay, and Toy Story 3, which is oriented towards preschool. The first two were distributed by Hasbro whereas the latter three were handled by Mattel.

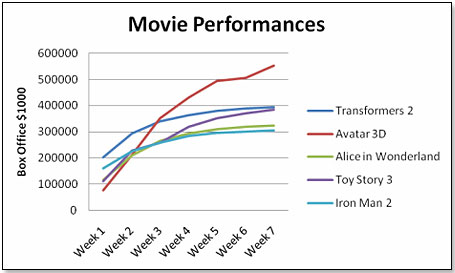

First, the box office results of the five movies – U.S. data up to and including the seventh week after release:

If toy sales depended on box office results alone, Avatar toys would have been a smashing success, Toy Story 3 toys and Transformers should have been on the same level, and Iron Man 2 and Alice in Wonderland should also have been very similar. This did not happen in the case of Avatar and Alice.

This is how the audience broke out in terms of demographics.

| Demographic |

General U.S. |

Trans-

formers 2 |

Alice in Wonder-

land |

Iron Man 2 |

Avatar |

Toy Story 3 |

| Male |

49.30% |

77.00% |

25.00% |

65.00% |

50.00% |

49.00%

|

| Female |

50.70% |

23.00% |

75.00% |

35.00% |

50.00% |

51.00% |

| < 24 years |

36.60% |

40.12% |

36.38% |

45.69% |

40.72% |

46.86% |

| 24 years > |

63.4% |

59.88% |

63.62% |

54.31% |

59.28% |

53.14% |

| Caucasian |

67.00% |

63.00% |

79.00% |

64.00% |

82.00% |

65.00% |

| Afro-American |

12.00% |

14.00% |

3.00% |

18.00% |

5.00% |

15.00% |

| Asians |

5.00% |

4.00% |

4.00% |

4.00% |

3.00% |

5.00% |

| Hispanics |

15.00% |

17.00% |

12.00% |

13.00% |

10.00% |

14.00% |

| Other Race |

1.00% |

1.00% |

2.00% |

1.00% |

1.00% |

1.00% |

| Family has Kids |

55.00% |

49.00% |

49.00% |

55.00% |

37.00% |

45.00% |

| Family has no Kids |

45.00% |

51.00% |

51.00% |

45.00% |

63.00% |

55.00% |

A few things immediately stand out. One is that the Transformers movie is in terms of demographics ideal for an action-figure program – extremely high male percentage, young, and pretty evenly spaced in racial terms. Alice in Wonderland is equally appropriate for a fashion doll toy range — extreme in its female percentage and a very high Caucasian participation. Iron Man 2 again is suitable for an action figure toy range – high male percentage, strong presence of youth and good racial mix. Avatar shows an odd picture — Caucasians dominate by far and so does the presence of singles. Toy Story 3 has the most balanced profile in terms of gender, age and race.

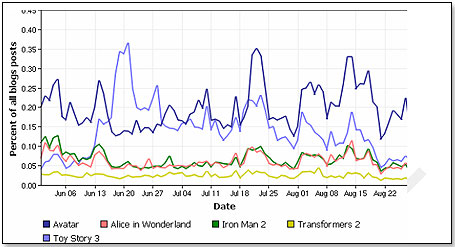

Another window into consumer reactions is provided by blog metrics that measure consumer interest:

This suggests that Avatar is still flying high, Toy Story 3 is slowly losing resonance, Alice and Iron Man 2 continue to maintain a moderately strong level and Transformers is no longer a major subject.

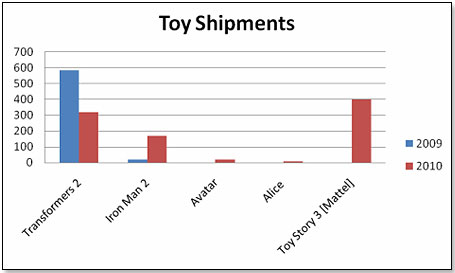

Now turning to what the manufacturers did with the license in terms of product development:

1. Transformers [Hasbro]: The product range was extremely well distributed at Wal-Mart, Target and ToysRUs and often had key merchandising locations in all of them. There are today [on 8/30] 70 action figure packs at ToysRUs with pricing ranging from $4.99 to $119.99. – with 27 packs below $10 and another 21 packs between $10 and $19.99.

2. Alice in Wonderland:[Mattel] - appeared only in ToysRUs and this only in one pack – The Mad Hatter at $54.99.

3. Iron Man 2:[Hasbro]: Again, Hasbro obtained excellent distribution in the three key toy retailers and also was often featured in key merchandising locations such as end caps at all three. There are today 49 action figure packs at ToysRUs with prices ranging from $6.99 to $114.99 – with 25 packs below $10 and 15 packs between $10 and $19.99.

4. Avatar [Mattel]– was very sparsely distributed just before the movie broke and put in another short appearance when the DVD was released. There is today no Mattel-manufactured Avatar toy at ToysRUs even though the longer movie version broke on August 29, 2010. However, there are quite a few non-Mattel SKUs at TRU, mainly Halloween products.

5. Toy Story 3 [Mattel] – excellent distribution and outstanding shelf placement, including key merchandising locations; at TRU, the flagship corner is currently devoted exclusively to Toy Story 3. There are today 88 Mattel toy products at ToysRUs with prices from $9.99 to $49.99 – with 53 packs below $10 and 24 packs between $10.00 and $19.99

This is how I estimate the toy sales by the manufacturers involved in each property [in US$ million, worldwide]

In summary, even if the movie has good box-office results, this does not automatically translate into good toy sales. If the audience of the movie is wrong in terms of the target group [Avatar] or if the product is not aligned to the audience profile [Alice], then sales will not be optimal. In the case of the Transformers 2, Iron Man 2 and Toy Story 3, all key factors were in concert – the movie was successful in box office terms, the audience demographics were right in terms of the target consumer group, and the toys were well distributed and priced appropriately.

Looking further into the future, there are four films of significant promise coming down the pike:

| Film |

Release Date |

Toy Manufacturer |

Genre |

Licensor |

| Harry Potter Deathly Hallows |

11/19/2010 |

Tomy/Necca |

Action Figures |

Warner |

Tangled

|

12/1/2010 |

Mattel |

Action Figures/ Fashion Dolls |

Disney |

| Tron Legacy |

12/17/2010 |

Spin Master |

Action Figures |

Disney |

| Chronicles of Narnia Dawn |

12/17/2010 |

Jakks Pacific |

Action Figures |

Disney |

The last two are of inordinate importance for the manufacturers concerned. In the case of Tron Legacy, this is the first time that Spin Master has a top-drawer Disney license and their performance will to a major degree influence their chances of obtaining equally potent licenses in the future. In the case of Chronicles of Narnia, this is the last film of the series and the manner in which Jakks handles it will determine whether they will continue to be seen as a credible licensing candidate, after having recently lost Care Bears and WWE to Hasbro and Mattel respectively.

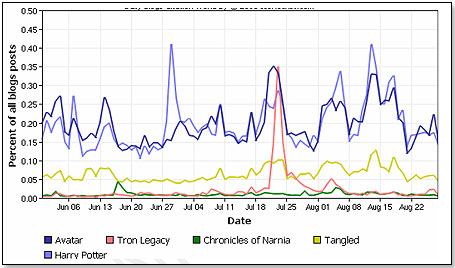

The current level of consumer interest is illustrated in the graph below - I included Avatar to allow comparison with the same metric further above:

Again, Avatar continues to be leading but only at a small margin over Harry Potter. Tangled looks respectably strong, whereas both Chronicles of Narnia and Tron Legacy appear to be struggling.

Current and very tentative demographic readings on the four properties show the following:

| Demographic |

General U.S. |

Harry Potter |

Tangled |

Tron Legacy |

Chronicles of Narnia Dawn |

| Male |

49.30% |

44.00% |

46.00%

|

75.00% |

43.00% |

| Female |

50.70% |

56.00% |

54.00% |

25.00% |

57.00% |

| < 24 years |

36.60% |

52.49% |

48.56% |

53.37% |

62.43% |

| 24 years > |

63.4% |

47.51%

|

51.44% |

46.63% |

37.57% |

This suggests that Tron Legacy has the best profile for its toy target audience – young boys. Both Harry Potter and Chronicles of Narnia appear to be somewhat too female-oriented for an action figure consumer group. Tangled has a good profile for fashion dolls but has not yet made much progress towards the 50:50 gender mix aspired to by Disney.

And, as always, the consumer will have the last word.

Writer's Bio: Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author

THIS BANNER IS AN AD:

• • • • • • • • • • • • • • • • • • | • • • • • • • • • • • • • • • • • • |

Back to TDmonthly's front page

|  |

Advertise on TDmonthly

|