|

Tools:

High-Tech Trio Rescues Video Game PublishersOnLive, Apple and One-Pass Weaken Alliances and Console Sales

| “If you assume that 30 percent of iPad usage will be devoted to games … this translates to 2.4 million consoles that potentially will not be sold by Sony, Microsoft and Nintendo.” |

For years, players in the video game space have been in an uneasy alliance that is now fraying at the edges.

Publishers depended on retailers to move their products but resented the fact that the same retailers — particularly GameStop — made an inordinate amount of money reselling used games, on which the publishers of these games made not a penny. Those publishers also needed the console makers for whom they tailored their products but resented the fact that the same console makers produced games in competition to theirs. Publishers depended on retailers to move their products but resented the fact that the same retailers — particularly GameStop — made an inordinate amount of money reselling used games, on which the publishers of these games made not a penny. Those publishers also needed the console makers for whom they tailored their products but resented the fact that the same console makers produced games in competition to theirs.

This uneasy alliance is now unraveling in the face of the ongoing decline in the video game market. There are a number of reasons for this decline, but one generally accepted as the major reason is that the current generation of consoles is about to be replaced by a new generation. Consumers are holding back buying the “old” generation machines, as they did during last console cycles, between 2002 and 2007. See “Video Games Sales Will Stagnate Before Surging”

CONSOLES AND GAMES FAIL TO SELL

Console sales have been negative 13 out of the last 14 months. This has two consequences:

1. Console makers, in order to compensate for this loss, need to put even more emphasis on their video game software sales in competition with the publishers.

2. A console is typically bought with about 10 games to go with it, and when the console does not sell, the attending games do not sell either.

Hence, video game publishers are seeking ways to change the equation in their favor.

Technology has just come to their rescue in the form of three developments:

1. OnLive

OnLive allows you to play any game “in the cloud” on your PC or Mac [or TV with a converter] by accessing via broadband games stored on OnLive’s servers. There is no need for additional hardware and no need to download anything. Access apparently is instantaneous and seamless via the OnLive website. See “OnLive Threatens Video Gaming As We Know It” OnLive allows you to play any game “in the cloud” on your PC or Mac [or TV with a converter] by accessing via broadband games stored on OnLive’s servers. There is no need for additional hardware and no need to download anything. Access apparently is instantaneous and seamless via the OnLive website. See “OnLive Threatens Video Gaming As We Know It”

Costs are two-fold: a $14.95 monthly subscription and the acquisition of games, either rented for three or five days, or bought outright. This service cuts out both the console makers and the retailers because all transactions are done online. The clear benefit is that you do not have to buy a console, which today costs around $250 (Microsoft’s Xbox 360) or $300 (Sony PS3). The downside is that you do not physically own the games you have bought — you cannot trade them in as used games and you lose them if you cancel your OnLive subscription.

OnLive came out of beta testing and went nationwide in late June and can now be accessed anywhere in the United States, provided the consumer has a broadband connection for 5 mbps or better. Thereby lies a rub, as the average mbps rate in the United States is only 3.5 and about 75 percent of the population in the contiguous United States cannot use the service as a result. A second drawback is that, at least up to now, OnLive does not provide motion sensing, so all games that depend on this technology will hence not work.

All major publishers are supporting the OnLive system. In addition to eliminating the possibility of reselling their games as pre-owned, there are two more benefits for them: It cuts out the retailer so the retail margin on 20 percent goes into the publishers’ pockets, and it eliminates pirates, which account for about 5 percent of all game usage in the United States.

2. One-Pass System

This is a quite brilliant move by publishers, who have, over years, fretted that they do not have any income from the huge and extremely profitable pre-owned game market that is virtually dominated by GameStop.

One-Pass is a simple system: When you buy a new game it comes in two portions. The first is a stripped version of the game similar to a demo model. The second comes in the form of a downloadable code that adds the real content of the game. This code can be downloaded only once. In other words, if you sell the game later as a pre-owned package, the code does not come with it and the buyer has to get the code from the publisher, typically at a cost of $10, in order to be able to play the game.

MCV UK quotes EA Sports President Peter Moore as saying in the context of the One-Pass system, “One thing I have to do, and it's my job, and my development team's job, and my marketing team's job, is make you not want to trade the game in.”

To demonstrate the size of the opportunity, the used game market in the United States in 2009 is estimated to have been $2,750 billion. According to analyst Michael Pachter of Wedbush-Morgan, 100 million used games changed hands last year. The average selling price per game was, hence, $27.50. The end effect, all things remaining equal, would be that $1 billion would now find its way into the publishers’ pockets.

Now, somebody will have to pay for this. Either the average selling price of the used game would increase by the same $10 to $37.50, the purchase price paid by retailers for the trade-in would drop from the current $14 down to $4, the retail margin of GameStop would drop from the current $14 down to $4, or a combination of all this.

This is likely to engender interesting outcomes. GameStop is unlikely to entertain a scenario whereby it sacrifices current margins on the used game business, which is, by far, the retailer’s most profitable category. Consumers are unlikely to visit retailers who will only pay them a third of their former price for used games. Equally, consumers are unlikely to pay $10 for the One-Pass of a used game because this would bring its price up to the level of a new game — rather, they would just buy a new game and not have any of the hassle. So, whatever happens, the publishers win and the retailers lose.

3. iPhone and iPad

What is generally not recognized in the hoopla attending the recent release of Apple’s iPad and the subsequent launch of the iPhone 4G is the impact these devices have already had on the video gaming sector and how this is likely to play out in the future.

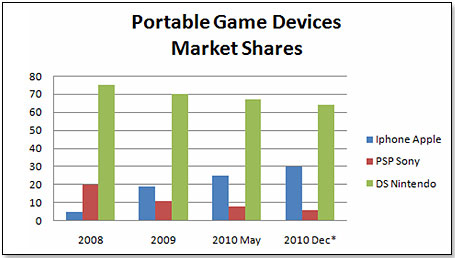

The iPhone has quietly and inexorably gained increasing acceptance as a portable video gaming device and has taken market shares from both leading portable video game consoles: the Sony PSP and the Nintendo DS:

This is likely to progress further given that the iPhone 4G will be an even better device for gaming given its faster processor, longer battery life, improved screen and three-axis gyroscope.

Again here, the beneficiaries are the video game publishers who were savvy enough to carve out a position as game suppliers to the iPhone. EA Mobile reported that Electronic Arts has 12 of its games among the top 20 iPhone apps. The losers are the retailers because they do not get to sell the consoles that have not sold as a result of the iPhone market share grab or the games that have migrated to Apple. Equally, Sony and Nintendo are losers in line with their market share losses.

comScore, Inc. recently conducted market research among 2,176 Internet users regarding their take on the iPad. They found that 34 percent of males indicated they were likely to use the iPad for playing video games, compared to 28 percent of females. More than 50 percent of 18- to 24-year-olds said they would likely use the iPad for this type of gaming, 15 percentage points above 25- to 34-year-olds, the next highest age group. comScore, Inc. recently conducted market research among 2,176 Internet users regarding their take on the iPad. They found that 34 percent of males indicated they were likely to use the iPad for playing video games, compared to 28 percent of females. More than 50 percent of 18- to 24-year-olds said they would likely use the iPad for this type of gaming, 15 percentage points above 25- to 34-year-olds, the next highest age group.

If you assume that 30 percent of iPad usage will be devoted to games, and that the iPad will sell 8 million units this year in the United States alone, this translates to 2.4 million consoles that potentially will not be sold by Sony, Microsoft and Nintendo. These three manufacturers sold, in 2009, 18.7 million Xboxes, Wiis and PS3s, and this number is expected to decline to 16 million this year, not counting impact from the iPad. In other words, the iPad could potentially reduce the sales by 15 percent this year alone. Again here, the winners are the publishers [and, of course, Apple]; the losers are the three console makers and the retailers because they do not get to sell the games that are all downloaded directly.

All three game changers together spell a really rough time for console makers and probably the demise of video game retailers over the next five to 10 years, unless both manage to adapt to these profound changes visiting the industry. Console makers will probably continue to cater to an increasingly smaller console consumer group and are likely to morph into device suppliers for the online gaming experience, providing such things as motion sensing add-ons and 3D facilitators. As for video game retailers, unless they can find another model for their brick-and-mortar stores, they are likely to go the way of the video and record stores.

Writer's Bio: Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author

THIS BANNER IS AN AD:

• • • • • • • • • • • • • • • | • • • • • • • • • • • • • • |

Back to TDmonthly's front page

|  |

Advertise on TDmonthly

|