|

Tools:

Why Toy Sales Will Strengthen But Won’t Beat ‘03Movies and Lower Prices Signal Hope for U.S. Toy Market in 2011

| “… they think we shall see for the first time in a decade two years with back-to-back growth.” |

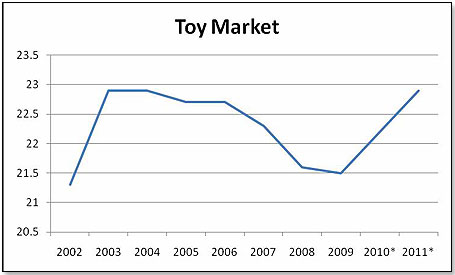

During this year’s Toy Fair and its aftermath, it became very clear that the buyers on my retail panel are taking a much more positive view of the U.S. toy market than they did a year ago. There are several reasons for this, but, in summary, they think we shall see for the first time in a decade two years with back-to-back growth. However, just to put this into perspective, even if they are right, the 2011 toy sales will, at best, equal toy sales in 2003. During this year’s Toy Fair and its aftermath, it became very clear that the buyers on my retail panel are taking a much more positive view of the U.S. toy market than they did a year ago. There are several reasons for this, but, in summary, they think we shall see for the first time in a decade two years with back-to-back growth. However, just to put this into perspective, even if they are right, the 2011 toy sales will, at best, equal toy sales in 2003.

So, what are the reasons for the buyers’ optimism?

1. The KGOY syndrome has run its course.

KGOY, “Kids Growing Older Younger,” describes the shifting downward of the age scale at which children switch from toys to entertainment products. Also known as “age compression,” it basically means that 10- and 12-year-olds in the 1990s still played with Barbie, whereas now children are more likely to stop playing with Barbie at age 5. This is a big deal, since American children represent a huge retail market, influencing about $500 billion in annual retail spending. There are no hard numbers to quantify this trend over the past 10 years, but the general consensus of opinion seems to be that it has affected the U.S. toy market by between 1 percent and 2 percent every year.

2. Overall, toy prices have come down, and this will foster demand.

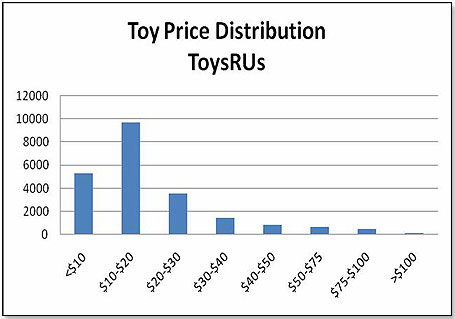

There was incredible pressure on toy manufacturers last year to lower prices on existing products and to introduce new products at more acceptable price points. The buyers believe that these new price levels will foster significantly greater demand, and they are quite determined to keep things this way.

This is how Toys “R” Us’ price distribution over its approximately 22,000 toy SKUs looks today:

|

Price

|

SKUs

|

%

|

|

<$10

|

5,292

|

24.1

|

|

$10-$20

|

9,692

|

44.1

|

|

$20-$30

|

3,519

|

16.0

|

|

$30-$40

|

1,422

|

6.5

|

|

$40-$50

|

818

|

3.7

|

|

$50-$75

|

641

|

2.9

|

|

$75-$100

|

481

|

2.2

|

|

>$100

|

129

|

0.6

|

|

|

21,994

|

100.0

|

|

|

|

|

Or the same in chart form:

Two years ago, the same chart would have looked very different in that the lowest price bracket [<$10] would, at best, have represented 10 percent of the total — not more than 20 percent as it does now.

3. Video games are in a holding pattern.

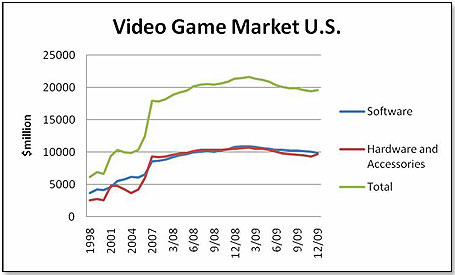

The buyers also believe video games had a fairly significant negative influence on the U.S. toy market but that this influence is likely to decline between now and when the new consoles come out in late 2011 and 2012. Current estimates are that about 15 percent of all children under age 10 are playing video games, at least occasionally. Also, video games sales tend to decline in anticipation of new console releases, as we saw between 2001 and 2006, per the chart below. See article: Video Game Sales Will Stagnate Before Surging

The buyers believe this temporary decline in the video game market will have a positive effect on toy sales.

4. There’s a very strong schedule of toy-related movies in 2010 and 2011.

The line-up of incredibly strong movies in 2010 and 2011 is quite unprecedented:

ACTION FIGURE MOVIES

|

Movie Titles 2010

|

Release

|

Toy Licensee

|

Box Office

Last Movie*

|

Date Last

Movie

|

|

Avatar

|

12/27/09**

|

Mattel

|

None

|

None

|

|

How to Train Your Dragon

|

3/26/20

|

Spin Master

|

None

|

None

|

|

Iron Man 2

|

5/7/10

|

Hasbro

|

$228.6 M

|

2008

|

|

Prince of Persia: The Sands of Time

|

5/28/10

|

Playmates/Vivid

|

None

|

None

|

|

The Last Airbender

|

7/2/10

|

Spin Master

|

None

|

None

|

|

Avatar [long version]

|

10/1/10

|

Mattel

|

$552.8 M

|

2009/10

|

|

Harry Potter and the Deathly Hollows: Part 1

|

11/19/10

|

Tomy/Neca

|

$294.2 M

|

2009

|

|

Tron Legacy

|

12/17/10

|

Spin Master

|

$33.0 M

|

1982

|

|

The Chronicles of Narnia: The Voyage of the Dawn Treader

|

12/17/10

|

Jakks Pacific

|

$135.5 M

|

2008

|

|

Movie Titles 2011

|

|

|

|

|

|

Thor

|

5/6/11

|

Hasbro

|

None

|

None

|

|

Green Lantern

|

6/17/11

|

Mattel

|

None

|

None

|

|

The Adventures of Tintin: The Secret of the Unicorn

|

6/23/11

|

|

None

|

None

|

|

Transformers 3

|

7/1/11

|

Hasbro

|

$393.7 M

|

2009

|

|

Pirates of the Caribbean 4: On Stranger Tides

|

7/2011

|

No licensee at this point***

|

$301.7 M

|

2007

|

|

|

|

|

|

|

|

Harry Potter and the Deathly Hollows: Part 2

|

7/15/11

|

Tomy/Neca

|

$294.2 M

|

2009

|

|

The Hobbit

|

12/11

|

****

|

$345.5 M

|

2003

|

*U.S. only to Week 7 inclusive

**included in 2010 line-up as release date was after Christmas 2009

***Neca had the license in 2007

****Marvel’s Toy Biz had the license in 2003

PRESCHOOL MOVIES

|

Movie Titles 2010

|

Release

|

Toy Licensee

|

Box Office

Last Movie*

|

Date Last

Movie

|

|

Sorcerer’s Apprentice

|

5/16/10

|

None appointed

|

None

|

None

|

|

Shrek Forever After

|

5/21/10

|

Playmates/Vivid

|

$307.8 M

|

2007

|

|

Toy Story 3

|

6/18/10

|

Mattel/Thinkways

|

$245.6 M

|

1999

|

|

Movie Titles 2011

|

|

|

|

|

|

Jack the Giant Killer

|

2011

|

?

|

?

|

1962

|

|

Kung Fu Panda: The Kaboom of Doom

|

6/3/11

|

Mattel

|

$206.6 M

|

2008

|

|

Cars 2

|

6/24/11

|

Mattel

|

$220.0 M

|

2006

|

|

The Smurfs

|

7/29/11

|

Jakks Pacific

|

$11.2 M

|

1983

|

*U.S. only to Week 7 inclusive

DOLLS

|

Movie Titles 2010

|

Release

|

Toy Licensee

|

Box Office

Last Movie

|

Date Last

Movie

|

|

Alice in Wonderland

|

3/5/10

|

Mattel

|

?

|

1951

|

|

Tangled [Rapunzel]

|

12/1/10

|

Mattel

|

None

|

None

|

|

Movie Titles 2011

|

|

|

|

|

|

Brave [The Bear and the Bow]

|

12/24/11

|

Mattel

|

None

|

None

|

*U.S. only to Week 7 inclusive

5. Opening inventories are much lower this year than at the beginning of 2009.

While this will not influence movement of toys out of stores, it is of great importance as far as buyers and manufacturers are concerned. There is no question that the inventory overhang at the end of 2009 was significantly lower than what we experienced a year earlier. During the first three months of 2009, clearance products occupied up to 30 percent of the toy space at certain mass retailers. Today, toy space devoted to clearance is probably down to less than 10 percent. It is my understanding that purchase order generation in the first round [end December/early January – for arrival of goods February] was very significantly above the same period last year, and the second round [end January/early February for March arrival] was moderately above the same period in 2009.

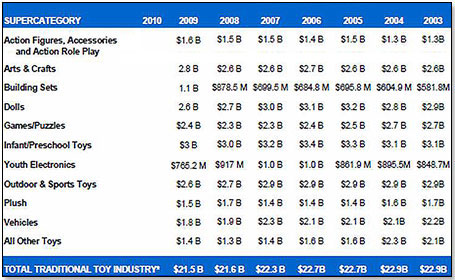

In summary, the buyers’ prediction of two years of back-to-back growth would take place against a backdrop of disappointing sales over the past six years. This is how they see the toy market developed up to last year, as per Toy Industry Association statistics [source NPD]:

While this is good news, we will — if these growth rates do, in fact, materialize — be, at the end of next year, only where we were back in 2003:

Writer's Bio: Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author

THIS BANNER IS AN AD:

• • • • • • • • • • • • • • | • • • • • • • • • • • • • |

Back to TDmonthly's front page

|  |

Advertise on TDmonthly

|