|

Tools:

How “Transformers” Resonates in Movies and ToysLicense Lines Up to Other Action Figures in 2010-2011

| “ … it is important for any toy marketer to know what movies are coming down the pike, who the licensees are, and what buyers are thinking of the movie as a toy driver.” |

Movies have emerged as the major driver of toy sales. The toy categories most targeted are action figures, construction, preschool, and, to a lesser degree, vehicles. There is virtually always a clear correlation between the box office of the movie and its audience demographics on one side, and the success of the licensed toy product on the other. More so, the effect tends to be cumulative in that the sequel tends to be more successful than the initial film, and the resonancy period — the time span between the various sequels in which the toy product continues to get the benefit from the movie — tends to be stronger the more sequels there are.

This resonancy factor is a major benefit for the toys that carry the license. While the box office sales of the movie tend to sharply diminish after the first week, the benefit to the toy products tends to kick in well before the movie is shown and also tends to last much longer. Here, we have a declining slope that increases over time, but the decline is much gentler and the benefits last much longer. This resonancy factor is a major benefit for the toys that carry the license. While the box office sales of the movie tend to sharply diminish after the first week, the benefit to the toy products tends to kick in well before the movie is shown and also tends to last much longer. Here, we have a declining slope that increases over time, but the decline is much gentler and the benefits last much longer.

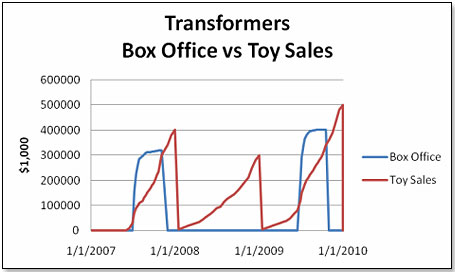

I have used the example of DreamWorks’ and Paramount Picture’s “Transformers” movie and its attending toy range — undoubtedly the most successful toy event of 2009 — to demonstrate the point:

Transformers sales shown are at retail in the U.S. only. Source: Klosters Trading retail panel

Transformers toy sales took off with the release of the first movie in 2007 but continued to climb after the last screening day and carried over into the following year. Moreover, the benefit of the second movie in 2009 set in much earlier and resulted in much higher sales.

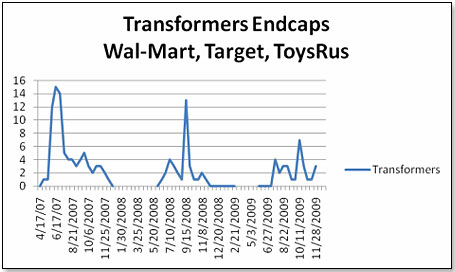

It is essential that the product that is backed by a successful movie also be well distributed and, equally important, well placed within the stores. In the specific case of the Transformers, the product was on endcaps and aisle caps with the three major toy retailers to the extent and the timing required to take most advantage of the movie:

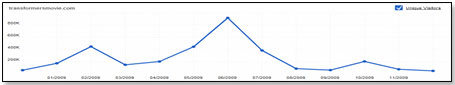

This resonancy period I mentioned above, which benefits the product backed by the movie, is also very well shown by the traffic on the movie’s website:

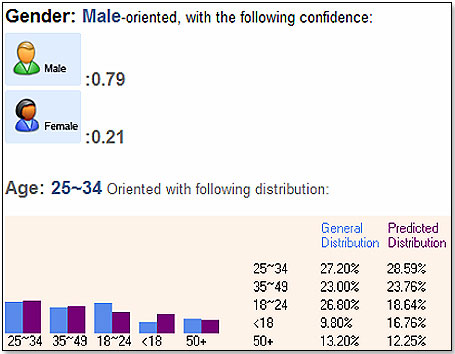

It might be useful to ask oneself what role audience demographics play in the success of a movie as a toy sale generator. Since Transformers as a toy clearly appeals to boys between 6 and 12 years old, which is the prime target group for action figures, the closer the movie audience demographics match this profile, the better the toy is likely to do. This is how the Transformers movie profile looks, at least as far as the Web traffic profile is concerned:

For an action figure toy, the gender profile is perfect. As far as the age distribution is concerned, the below-18 percentage is nearly double the national average and hence extremely good.

While a successful movie will, up to a point, drive the entire category, it is still essentially a zero-sum game. The success of Transformers comes at the expense of its competitors. Hence, it is important for any toy marketer to know what movies are coming down the pike, who the licensees are, and what buyers are thinking of the movie as a toy driver.

I show below the movie schedule as it affects toys, for both 2010 and 2011. You will see that there is a ranking. This has been provided by national buyers at the big-box stores and represents a composite of their opinions. However, when looking at this, please remember that buyers can also be wrong — they clearly were in the case of “The Princess and the Frog” because they (and I) were caught unaware by the extreme audience demographics of the movie.

2010 Movie Lineup

| Producer |

Title |

Release Date |

Rank |

Toy Licen-

see |

Second Licen-

see |

Box Office

Last Movie* |

Release Date |

| Disney |

Alice in Wonder-

land |

3/5/10 |

7 |

Mattel |

Medicom |

n/a |

1951 |

| Hasbro |

Iron Man 2 |

5/7/10 |

4 |

Hasbro |

Mega Brands |

$228.6

M |

2008 |

| Disney |

The Sorcerer's Apprentice |

5/16/10 |

11 |

None |

None |

None |

None |

| Dream Works |

Shrek Forever After |

5/21/10 |

1 |

Playmates (N. America); Vivid (Int'l) |

Lego |

$307.8

M |

2007 |

| Disney |

Prince of Persia: The Sands of Time |

5/28/10 |

5 |

McFarlane |

Lego |

None |

None |

| Disney |

Toy Story 3 |

6/18/10 |

2 |

Mattel; Thinkaway Toys |

Lego |

$208.8

M |

2009 |

Para-

mount |

The Last Airbender |

7/2/10 |

9 |

Spin Master Toys |

None |

None |

None |

| Warner |

Harry Potter and the Deathly Hollows |

11/19/10 |

3 |

Tomy (Int'l); NECA (N. America) |

Lego |

$294.2

M |

2009 |

| Disney |

Rapunzel |

12/1/10 |

8 |

Mattel |

Lego |

None |

None |

| Disney |

Tron Legacy |

12/17/10 |

10 |

Spin Master Toys |

Lego |

$33 M |

1982 |

| Fox |

The Chronicles of Narnia: The Voyage of the Dawn Treader |

12/17/10 |

6 |

Jakks Pacific |

None |

$135.5

M |

2008 |

*box office in US only, in $ millions, cumulative to the seventh week after release

You will notice a bunching of action figure movies that is quite unprecedented and that is likely to have a negative effect on Hasbro’s single entry, the Iron Man, which is a second-tier movie compared to the Transformers and Star Wars blockbusters.

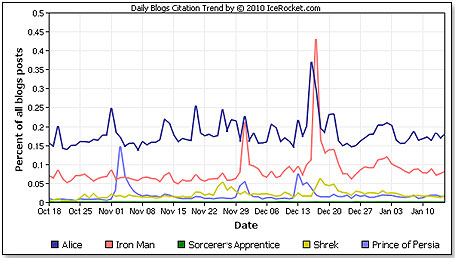

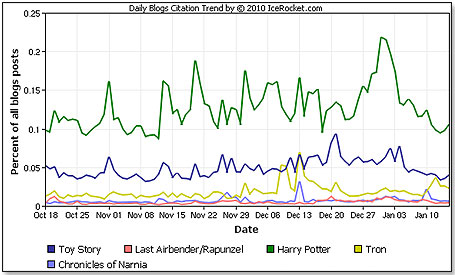

However, it is also instructive to see how the blog metrics look for each of these movies. Blog metrics measure the chatter on the web about a given subject, and a high noise level normally denotes high interest levels. According to this, “Alice,” “Harry Potter” and “Iron Man” would be in the lead right now.

The table below shows the 2011 line-up:

2011 Movie Lineup

| Producer |

Title |

Release Date |

Rank |

Toy Licen-

see |

Second Licen-

see |

Box Office Last Movie* |

Release Date |

| Warner Bros. |

Jack the Giant Killer |

2011 |

13 |

? |

? |

? |

1962 |

| Marvel |

Thor |

5/6/11 |

5 |

Hasbro |

? |

None |

None |

| Warner Bros. |

Green Lantern |

6/17/11 |

10 |

Mattel |

|

None |

None |

| Paramount |

The Adventures of Tintin: The Secret of the Unicorn |

6/23/11 |

8 |

? |

? |

None |

None |

| Disney |

Cars 2 |

6/24/11 |

6 |

Mattel |

Lego |

$220.0

M |

2006 |

| Disney |

Pirates of the Caribbean: On Stranger Tides |

7/1/11 |

3 |

|

Lego |

$301.7

M |

2007 |

| Hasbro |

Transfor-

mers 3 |

7/1/11 |

1 |

Hasbro |

|

$393.7

M |

2009 |

| Warner Bros. |

Harry Potter and the Deathly Hollows: Part II |

7/15/11 |

4 |

Tomy; NECA |

Lego |

$294.2

M |

2009 |

| Disney |

The Smurfs |

7/29/11 |

11 |

Jakks Pacific |

|

$11.2

M |

1983 |

| MGM |

The Hobbit: Part 1 |

12/1/11 |

2 |

? |

Lego |

$345.3

M |

2003 |

| Disney |

The Bear and the Bow |

12/24/11 |

12 |

Mattel |

|

None |

None |

*box office in US only, in$ millions, cumulative to the seventh week after release

Note: Star Trek was ranked No. 7; however, its release is now slated for 2012.

Again in 2011 we see an inordinate number of good action figure movies, reduced from their initial line-up by the delay of Spiderman into 2012. While there is little question that again Transformers will reign supreme, the effect of the movie on Hasbro’s toy sales is likely to be somewhat muted given the strength of competitive films following it.

Writer's Bio: Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author

THIS BANNER IS AN AD:

• • • • • • • • • • • • • | • • • • • • • • • • • • |

Back to TDmonthly's front page

|  |

Advertise on TDmonthly

|