|

Tools:

Hello, Zhu Zhu Pets, Goodbye WebkinzCepia’s Hamsters Boogie Past Ganz’s Virtual Pets

| “On Amazon, Zhu Zhu Pets has 19 products in the top-selling 100 products in the Electronics for Kids category, whereas Webkinz has one: No. 91.” |

I was widely derided when I wrote in August 2008 that:

“I must conclude that the growth of the virtual playground concept has, at least in the United States, slowed in terms of traffic and interest.”

And then, in July of this year, I said in this space:

“All indications are that the virtual playgrounds around the world have not lived up to the widely held expectation that they could somehow defy the dynamics governing brick-and-mortar toy sales. The picture is pretty much identical for both spaces: sales are declining, interest levels are waning, and electronics continue to take bites out of the traditional toy market, whether it is housed in brick and mortar or in cyberspace.”

As it turned out, sales were, in fact, falling off a cliff. According to the NPD Group, sales for Web-connected play toys dropped 41 percent this year through August. And the main culprit responsible for this decline was, apparently, Webkinz by Ganz. As it turned out, sales were, in fact, falling off a cliff. According to the NPD Group, sales for Web-connected play toys dropped 41 percent this year through August. And the main culprit responsible for this decline was, apparently, Webkinz by Ganz.

All indications are that there is one toy that is picking up the pieces: Zhu Zhu Pets™. The product range is manufactured in China in four factories, up from one factory six months ago, for Cepia LLC. Cepia is a small, privately held company located in St. Louis, Mo. The company is owned by Russ Hornsby and has a total staff of 16, including Hornsby as CEO and Natalie, his daughter, as VP of marketing. Hornsby is the inventor of the Zhu Zhu Pets and owns the worldwide rights for the product.

Similar in many ways to Tamagotchi, the Zhu Zhu Pets are battery-powered toys that are probably the closest alternative to real hamsters. They are described as “realistic, interactive, plush, and artificially intelligent.” A Zhu Zhu Pet does everything a real hamster does, without the mess or trouble with feeding and cleaning (and dying). And it does so without a virtual playground.

Zhu Zhu Pets were test-marketed in late May-early June 2009, including a special promotion at Chase Field on Sunday, May 31, at the Arizona Diamondbacks’ game against the Atlanta Braves in Phoenix. Upon entering the stadium, the first 5,000 children in attendance were given a Zhu Zhu Pets hamster mask. That was probably the last time a Zhu Zhu product was easily obtainable because the toys immediately went ballistic and have been out of stock ever since. Hornsby emailed me on Aug. 6, saying, “the product is ON FIRE.” Zhu Zhu Pets were test-marketed in late May-early June 2009, including a special promotion at Chase Field on Sunday, May 31, at the Arizona Diamondbacks’ game against the Atlanta Braves in Phoenix. Upon entering the stadium, the first 5,000 children in attendance were given a Zhu Zhu Pets hamster mask. That was probably the last time a Zhu Zhu product was easily obtainable because the toys immediately went ballistic and have been out of stock ever since. Hornsby emailed me on Aug. 6, saying, “the product is ON FIRE.”

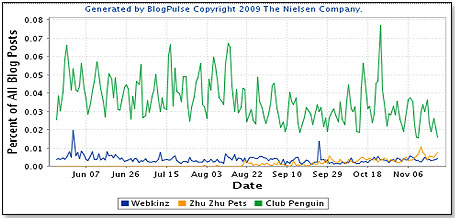

Zhu Zhu Pets made their first material appearance in the Blog Sphere — which denotes consumer interest — back in July. This is how Zhu Zhu developed in comparison to Club Penguin and Webkinz, demonstrating that it is in ascendancy and the latter two are in decline:

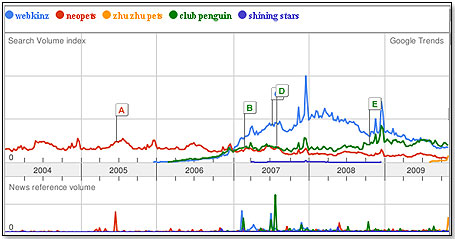

Google Trends, which measures product-related searches, shows similar patterns.

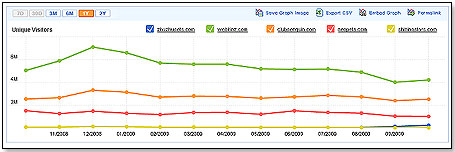

So do the individual websites:

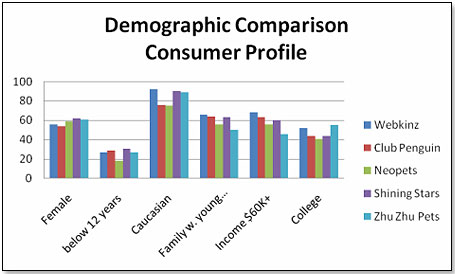

Yet, I do not see the significant differences in the consumer profile of the five brands that could explain Zhu Zhu’s runaway success:

In fact, Natalie Hornsby believes the Zhu Zhu consumer group is 70-percent female, 30-percent male, with the former in the age groups 4 to 8 years old and the latter between 4 and 6 years old.

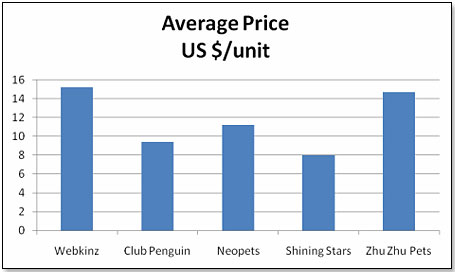

Zhu Zhu Pets is at Toys “R” Us on the same price level as Webkinz — way above the other brands:

Note: Cepia created the Zhu Zhu Pets Hamster with the economy in mind, and it was initially priced for retail at $7.99. However, due to the popularity and scarcity of the product, retailers are tempted to increase the price; therefore, it's actually sold at a number of different price points.

In summary, all five products are well made, attractive, and appeal pretty much to the same consumer group. Zhu Zhu Pets are premium priced, a fact that should work against them in this economic climate. In addition, Zhu Zhu Pets is the only brand that has no virtual playground — an attribute that as little as two years ago was touted as the major positive differentiator for toys.

And yet, Zhu Zhu Pets have been found out of stock at Wal-Mart, Target and Toys “R” Us, whereas the other brands have plenty of inventory and are moving slowly, if at all. On Amazon, Zhu Zhu Pets has 19 products in the top-selling 100 products in the Electronics for Kids category, whereas Webkinz has one: No. 91. There are no Club Penguin, Neopets or Shining Stars in the top 100 at all. And this runaway success is not restricted to the United States. In the UK, where they are called GoGoPets, Toys “R” Us is totally out of stock, too, as is ASDA [Walmart UK].

At this point in time, 95 percent of Zhu Zhu Pets are being sold in the mass market, and only about 5 percent in specialty, mainly Hallmark stores. This is quite atypical, in that an entrepreneurial product normally starts in specialty and then eventually graduates to mass. The reason why this did not happen this way is that Cepia, as a small company, had neither the finance nor the facilities to keep a lot of inventory in the United States. They hence sold the product in container loads FOB China and were paid at the moment the goods left their Chinese factories. The only retailers who had the finance and the supply chain resources to do this were the big boys. Some Hallmark stores banded together and pooled their purchases so they could fill at least one container and this is how, today, Hallmark is pretty much the only non-mass retailer carrying the product. While this disappointed the many small retailers who did not have this facility, it appears that Cepia’s explanations were generally accepted by them and kept relationships on an even keel. At this point in time, 95 percent of Zhu Zhu Pets are being sold in the mass market, and only about 5 percent in specialty, mainly Hallmark stores. This is quite atypical, in that an entrepreneurial product normally starts in specialty and then eventually graduates to mass. The reason why this did not happen this way is that Cepia, as a small company, had neither the finance nor the facilities to keep a lot of inventory in the United States. They hence sold the product in container loads FOB China and were paid at the moment the goods left their Chinese factories. The only retailers who had the finance and the supply chain resources to do this were the big boys. Some Hallmark stores banded together and pooled their purchases so they could fill at least one container and this is how, today, Hallmark is pretty much the only non-mass retailer carrying the product. While this disappointed the many small retailers who did not have this facility, it appears that Cepia’s explanations were generally accepted by them and kept relationships on an even keel.

To determine why Zhu Zhu Pets are doing so phenomenally well, it behooves us to look at the reason Webkinz, the market leader, is doing so badly. Here, the comments from a specialty retailer on the West Coast are interesting:

“Webkinz at first were specialty only. RETAILERS built the demand through a push marketing program. There was no advertising. As the toy was a new concept, we had to explain it to customers. The toy itself had little value — it was the website. And the kids loved the website. New Webkinz gave kids new features, and as with many hot items, the collectible factor was key. The manufacturer sold directly to the retailer and created poor retailer relations by taking the retailer for granted. The manufacturer would not provide honest information and often opened side channels as they told the specialty market that they were only selling through them. Webkinz have run their course.”

Another specialty retailer, from the East Coast, had this to say:

“Webkinz got its start from the small guys, little toy retailers who were sharp enough and courageous enough to see the potential in Webkinz and to risk their hard earned dough on the product. They were badly repaid. Webkinz mistreated them in every possible way — they did not ship on time, they forced small retailers to take in unwanted merchandise just to get Webkinz once it became popular, they did not return calls, they left us alone to handle irate consumers unhappy with the website — in short, they .....ed [expletive deleted] us in every possible way.”

So, Webkinz, for one reason or another, lost its primary base, the specialty retailers, and never quite got the hang of doing business with the Wal-Marts of this world — this, at least, is the perception of a number of national buyers at the large retailers.

In addition, they also began to lose the consumer. On Customer Service Scoreboard, Webkinz has a customer service rating of “terrible.”

In addition, Ganz consistently had and continues to have major technical problems associated with the Webkinz website, which, after all, is an integral part of its main claim to fame. Wikipedia, on its Webkinz page last updated on Nov. 13, 2009, had this to say on this subject:

"Another area of parental concern is that there are many problems with connecting to the Webkinz World site. These range from technical problems with customer's internet browsers [16] to programming problems at the Webkinz World site.[17] Changes made to the Webkinz World site have resulted in many disappointed users as newly introduced features often limit access to a small fraction (less than 1%) of users [18] and programming errors often reduce the ability of the remainder of the site to function at prior levels. Other programming errors have caused many users to lose virtual items, Kinzcash and even pets and entire rooms.[19] Reportedly, Ganz customer service corrects many of these problems within two weeks.[20][21]."

So, Ganz first lost its retailers and then its consumers. And Cepia, with its Zhu Zhu Pets, is now filling the void.

Editor's Note: Susan McVeigh, communications manager for Ganz, provided this statement:

"Being a private company, Ganz does not divulge figures. What we will say is that to paraphrase Mark Twain, 'The reports of our death in this article have been greatly exaggerated.' While it is true we are — thankfully — no longer inundated with the fad frenzy of Webkinz popularity, it is equally true that Webkinz still has a very strong following with very solid sales. We continue to develop wonderful content on www.webkinz.com. In addition, we are always developing our core Webkinz product line as well as adding new brands under the Webkinz umbrella, such as Webkinz Signature and Zumbuddies, which are retailing exceptionally well."

Every fad ends somewhere and very few manage to morph from a fad into a lasting brand. The warehouses, attics and landfills of this land are littered with Furbies, Beanie Babies and Pet Rocks. Whether Cepia can transform the Zhu Zhu phenomenon into a lasting presence on the toy scene depends on a number of things: Will they build an infrastructure that accommodates the needs not only of the large retailers but also of the small guys, will they begin to support the brand with promotions and media, and most importantly, will they continue to keep the brand fresh with new and creative line extensions? Only time will tell.

Writer's Bio: Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author

THIS BANNER IS AN AD:

• • • • • • • • • • • • • • • • • | • • • • • • • • • • • • • • • • |

Back to TDmonthly's front page

|  |

Advertise on TDmonthly

|