April 1, 2025

November 2011 | Vol. X - No. 11

Sea Change in Toy Land - Mattel Acquires HIT

How Mattel's Purchase of HIT Will Change the Worldwide Toy Market

The announcement that Mattel had bought HIT Entertainment came as a major surprise to many, and was a very ominous piece of news to a number of Mattel’s competitors. It’s not surprising – HIT is one of the major players in the Preschool category of the worldwide toy market and has a number of brands that are rightly regarded as major icons.

The announcement that Mattel had bought HIT Entertainment came as a major surprise to many, and was a very ominous piece of news to a number of Mattel’s competitors. It’s not surprising – HIT is one of the major players in the Preschool category of the worldwide toy market and has a number of brands that are rightly regarded as major icons.

Why did Mattel buy HIT?

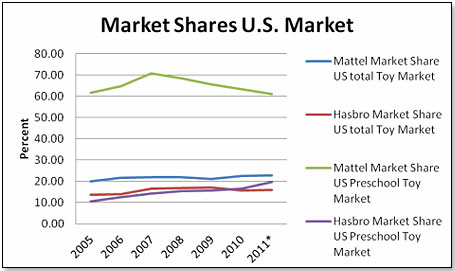

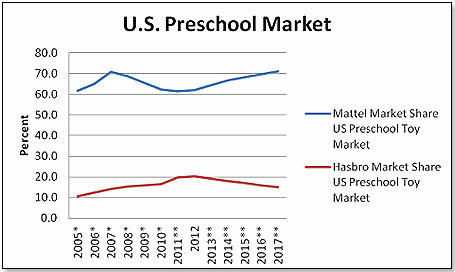

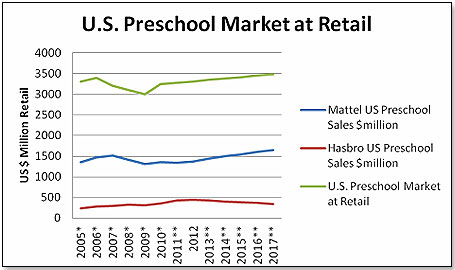

The market share development in the Preschool toy category, which is incidentally the largest category in terms of toy sales, tells the story:

*estimated for 2011, numbers for years 2005 to 2010 are from SEDC filings

Mattel has taken a hammering since 2007 in this vital part of the U.S. toy market and Hasbro, its single largest competitor, has steadily grown in the category and taken market share. This trend was accelerated when Mattel lost, and Hasbro won, the Sesame Street license at the end of last year.

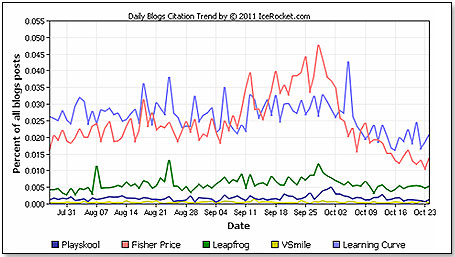

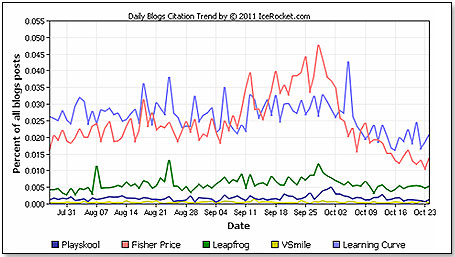

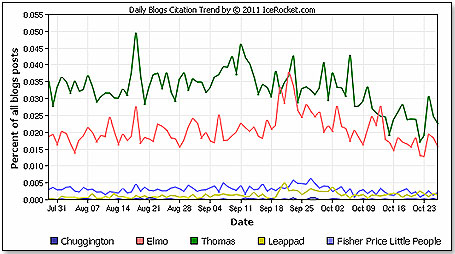

Blog metrics, which tend to signal consumer interest in a brand, paint an even more disconcerting picture:

Fisher-Price is being beaten by the Learning Curve of RC2/Takara Tomy and has shown clearly declining metrics since the beginning of the absolutely vital fourth quarter.

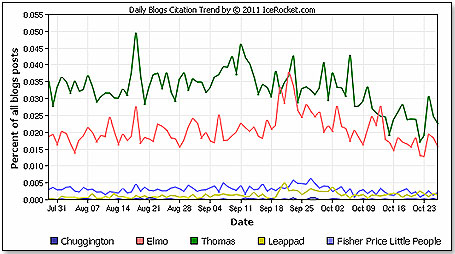

A similar picture emerges when you look at individual brands:

The battle is clearly between Thomas and Elmo [of Sesame], and the latter is narrowing the gap between the two. In addition, Let’s Rock Elmo is widely thought to be one of the major breakthrough toys this year and is likely to overtake Thomas in terms of consumer interest. No wonder that Mattel got nervous and decided to do something drastic about its market position.

Why HIT in particular?

The reasons are numerous but one of them is the size of the HIT business. HIT is probably the largest independent owner of Preschool intellectual properties in the world today. They have a total license income of $180 million, which translates to a top line sales number of above $1 billion between all their licensees – toy products and others. Of this, slightly less than half is in toy brands alone. The largest piece of this is Thomas & Friends, of which Mattel already has the diecast toy license – the wooden part of the toy license is held by Tomy/RC2. This relationship between Mattel and HIT, and the outstanding performance Mattel demonstrated in handling Thomas last and this year, were probably the deciding factors why Mattel, and not one of the other contenders, walked away with the prize.

The reasons are numerous but one of them is the size of the HIT business. HIT is probably the largest independent owner of Preschool intellectual properties in the world today. They have a total license income of $180 million, which translates to a top line sales number of above $1 billion between all their licensees – toy products and others. Of this, slightly less than half is in toy brands alone. The largest piece of this is Thomas & Friends, of which Mattel already has the diecast toy license – the wooden part of the toy license is held by Tomy/RC2. This relationship between Mattel and HIT, and the outstanding performance Mattel demonstrated in handling Thomas last and this year, were probably the deciding factors why Mattel, and not one of the other contenders, walked away with the prize.

HIT has a total of eight brands, of which only Thomas & Friends is today well known in the United States The other brands are a factor only internationally, mainly in Europe - Bob The Builder, Fireman Sam, Angelina Ballerina, Mike the Knight, Pingu, Barney, and Rainbow Magic.

The best selling brand amongst these is Thomas & Friends. Bob the Builder, Fireman Sam and Mike the Knight are all sold in the UK by Character Options but their toys are not yet available in the U.S. Mattel also holds the license for Angelina Ballerina, but distribution of the doll range in the U.S. is handled by Madame Alexander, whereas Mattel launched the range in the UK a few months ago. Takara Tomy handles Pingu for Japan (the world’s second largest toy market after the U.S.) and does fantastically well there. Barney, one of the best selling toys of the nineties, pretty much fell off a cliff about ten years ago. A relaunch in the U.S. was attempted last year by Russ Berrie but came to naught when Russ went bankrupt a few months ago. Rainbow Magic is a line of books mainly targeting girls, published by Orchard  Books and concentrated on the UK market. All these brands except for Barney and Mike the Knight have their own ongoing TV series which are widely distributed internationally and will undoubtedly represent a very solid base on which to build a geographically diversified toy business. Given Mattel’s pervasive presence worldwide, they will have no problem taking advantage of this potential and to put these brands on the map in the United States as well.

Books and concentrated on the UK market. All these brands except for Barney and Mike the Knight have their own ongoing TV series which are widely distributed internationally and will undoubtedly represent a very solid base on which to build a geographically diversified toy business. Given Mattel’s pervasive presence worldwide, they will have no problem taking advantage of this potential and to put these brands on the map in the United States as well.

While the majority of sales for these brands take place outside the United States, I would rate their potential success in the United States as very significant.

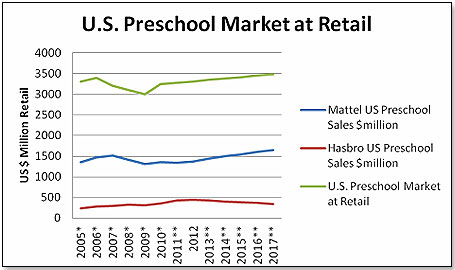

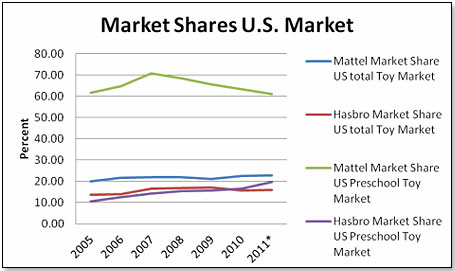

When projecting the U.S. Preschool toy market and Mattel and Hasbro’s participation in it, I was guided by the following assumptions:

- The U.S. Preschool market will grow in Dollar terms in line with the growth in the 1 – 9 years age segment, e.g. 1.01% per year as forecasted by the U.S. Census Bureau. This also assumes that the price deflationary effect of goods produced in China will have come to an end.

- Other than integrating the businesses now handled by third-party licensees, gradually starting with the Thomas wooden business take over from RC2 in January 2013 and ending in 2017, Mattel will not make any further acquisitions in this field during this period, and will organically grow by the same 1.01% by which the market grows. I have also assumed that the geographic split between the U.S. and international markets for the secondary brands to be 1/3 versus 2/3.

- Hasbro will, in turn, not make any acquisitions in the Preschool category and will between 2013 and 2017 lose market share in the U.S. by approximately half of what Mattel is gaining.

This is hence how the overall Preschool market in the U.S. and the respective sales of the two protagonists are likely to develop:

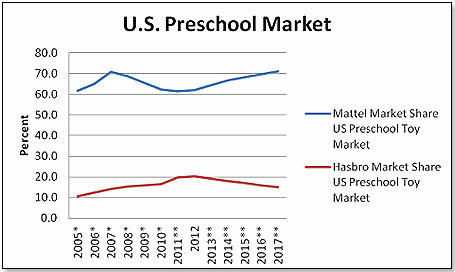

and this leads to the following market share curves:

The acquisition of HIT suggests a major shift in market positioning of Mattel versus its competitors. This view is seconded by several national buyers at large retailers both here in the United States as well as in Europe whom I asked what they thought about all this. This is what one of the U.S. national toy buyers said:

“Mattel has clearly shown that they are excellent in handling preschool properties and they will take the HIT brands to a much stronger place than they are today. This will spell really trouble for all the other companies engaged in this field.”

And from a buyer located with a large retailer in Europe:

And from a buyer located with a large retailer in Europe:

“Mattel buying HIT suggest to me that they are focusing on getting a much larger market share not only in Preschool but also in the total toy market. The kids you get when they are very young will give your brand preference as they get to Kindergarten and beyond. The way to build dominance is to start with the little guys and this is obviously what Mattel is doing.”

A third buyer, in Japan, had this take on it:

“Nobody so far has been able to touch Takara Tomy in Japan but, with Mattel getting Pingu as part of HIT, this could now change.”

It is not only the growing dominance of Mattel in the Preschool category in the United States that signals a structural shift at the expense of Hasbro; the shift will likely be even more pronounced in the much larger international market, in which Hasbro has been fighting an uphill battle with some success of late. In short, if all my assumptions given above play out, Hasbro will have to accept in the longterm a very modest secondary position, not only in the Preschool Category but also in the overall worldwide toy market.

Is this, in fact, likely to happen? Yes, it will…unless Hasbro takes the eminently logical step to reestablish their competitive status versus Mattel by making a very major acquisition in the toy space as well. This possibility should definitely not be ruled out.

Copyright © 2025 TDmonthly®, a division of TOYDIRECTORY.com®,

Inc.

The announcement that Mattel had bought HIT Entertainment came as a major surprise to many, and was a very ominous piece of news to a number of Mattel’s competitors. It’s not surprising – HIT is one of the major players in the Preschool category of the worldwide toy market and has a number of brands that are rightly regarded as major icons.

The announcement that Mattel had bought HIT Entertainment came as a major surprise to many, and was a very ominous piece of news to a number of Mattel’s competitors. It’s not surprising – HIT is one of the major players in the Preschool category of the worldwide toy market and has a number of brands that are rightly regarded as major icons.

The reasons are numerous but one of them is the size of the HIT business. HIT is probably the largest independent owner of Preschool intellectual properties in the world today. They have a total license income of $180 million, which translates to a top line sales number of above $1 billion between all their licensees – toy products and others. Of this, slightly less than half is in toy brands alone. The largest piece of this is Thomas & Friends, of which Mattel already has the diecast toy license – the wooden part of the toy license is held by Tomy/RC2. This relationship between Mattel and HIT, and the outstanding performance Mattel demonstrated in handling Thomas last and this year, were probably the deciding factors why Mattel, and not one of the other contenders, walked away with the prize.

The reasons are numerous but one of them is the size of the HIT business. HIT is probably the largest independent owner of Preschool intellectual properties in the world today. They have a total license income of $180 million, which translates to a top line sales number of above $1 billion between all their licensees – toy products and others. Of this, slightly less than half is in toy brands alone. The largest piece of this is Thomas & Friends, of which Mattel already has the diecast toy license – the wooden part of the toy license is held by Tomy/RC2. This relationship between Mattel and HIT, and the outstanding performance Mattel demonstrated in handling Thomas last and this year, were probably the deciding factors why Mattel, and not one of the other contenders, walked away with the prize.  Books and concentrated on the UK market. All these brands except for Barney and Mike the Knight have their own ongoing TV series which are widely distributed internationally and will undoubtedly represent a very solid base on which to build a geographically diversified toy business. Given Mattel’s pervasive presence worldwide, they will have no problem taking advantage of this potential and to put these brands on the map in the United States as well.

Books and concentrated on the UK market. All these brands except for Barney and Mike the Knight have their own ongoing TV series which are widely distributed internationally and will undoubtedly represent a very solid base on which to build a geographically diversified toy business. Given Mattel’s pervasive presence worldwide, they will have no problem taking advantage of this potential and to put these brands on the map in the United States as well.

And from a buyer located with a large retailer in Europe:

And from a buyer located with a large retailer in Europe: