November 21, 2024

In September 2009, just after the acquisition of Marvel by Disney, I suggested that this acquisition was a defensive move from the side of Disney because they saw Time Warner encroaching upon their territory. I said that

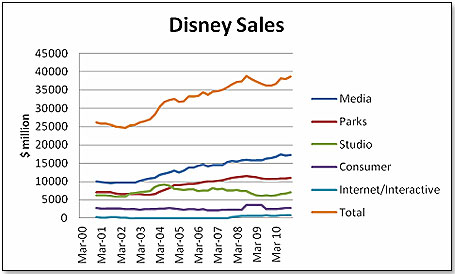

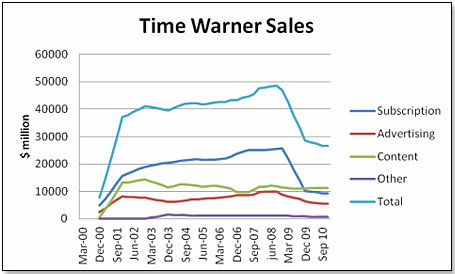

In September 2009, just after the acquisition of Marvel by Disney, I suggested that this acquisition was a defensive move from the side of Disney because they saw Time Warner encroaching upon their territory. I said that So, where are the two companies now, 16 months later?“Disney has been watching the ongoing transformation of Warner, its main competitor in the children’s entertainment field, with increasing concern. By shedding first its cable business, and now getting rid of the AOL stone around its neck [which happened on 12/9/2009], Warner is focusing more and more on content – films for theaters and TV, Video products, licenses and consumer products. This puts them squarely into the road which Disney is also traveling.”

| DISNEY Channels | 2nd Week 2011 Households ‘000 | 2nd Week 2010 Households ‘000 | % +/- |

| DSNY | 1416 | 1356 | + 4.4 |

| ESPN | 1139 | 765 | +48.9 |

| AEN | 788 | 740 | + 6.5 |

| HIST | 683 | 583 | + 7.2 |

| FAM | 494 | 541 | - 8.8 |

| LIF | 470 | 564 | - 16.7 |

| TOTAL | 4990 | 4549 | + 9.7 |

| WARNER Channels |

Week 1/10/11 Households ‘000 |

Week 1/10/10 Households ‘000 |

% +/- |

| NICK | 1819 | 1730 | +5.1 |

| NAN | 1347 | 1380 | - 2.4 |

| TNT | 1077 | 1118 | - 3.7 |

| ADSM | 953 | 969 | - 1.7 |

| TOON | 772 | 846 | - 8.8 |

| TBSC | 712 | 744 | - 4.3 |

| TOTAL | 7252 | 7407 | - 2.1 |

Movies and License Income

Movies and License Income| Studio | U.S Domestic Sales [$million] |

International Sales [$million] |

Total Ticket Sales [$million] |

| Time Warner | 1880 | 2930 | 4810 |

| Fox | 1480 | 2900 | 4380 |

| Disney | 1460 | 2300 | 3760 |

| Paramount | 1710 | 1980 | 3690 |

| Sony | 1280 | 1380 | 2660 |

| Universal | 885 | 1200 | 2005 |

| Studio | DVD Sales [$million] |

| Time Warner | 503 |

| Fox | 319 |

| Disney | 527 |

| Paramount | 313 |

| Sony | 308 |

| Universal | 242 |

| MovieWeb Rating |

Film Title | Release Date | Producer | Earlier Film Version Date |

Earlier Film Box Office $ million |

| 4.5 | Harry Potter, Deathly Hollows 2 | 7/15/11 | Warner | 2010 | 903 |

| 3.3 | Red Riding Hood | 3/11/11 | Warner | None | None |

| 5.0 | Sucker Punch [Rated R] |

3/25/11 | Warner | None | None |

| 4.6 | Hangover Part 2 | 5/26/11 | Warner | 2009 | 467 |

| 4.8 | Green Lantern | 6/17/11 | Warner | None | None |

| 5.0 | Sherlock Holmes 2 | 12/16/11 | Warner | 2009 | 524 |

However, the author of the Harry Potter book series, Ms. J. K. Rowling, has already said that Deathly Hollows is her last. There will hence be no further Harry Potter films following the Deathly Hollows 2 this year and one of Warner’s major money spinners has gone west with no replacement on the horizon. This is a major setback to Warner who have a great number of license properties but only one other of a similar caliber – Batman. All the other properties are either adult-oriented and hence not prime licensing material or they are children-focused but of second-tier quality – ThunderCats, Scooby Doo, Red Riding Hood etc.

However, the author of the Harry Potter book series, Ms. J. K. Rowling, has already said that Deathly Hollows is her last. There will hence be no further Harry Potter films following the Deathly Hollows 2 this year and one of Warner’s major money spinners has gone west with no replacement on the horizon. This is a major setback to Warner who have a great number of license properties but only one other of a similar caliber – Batman. All the other properties are either adult-oriented and hence not prime licensing material or they are children-focused but of second-tier quality – ThunderCats, Scooby Doo, Red Riding Hood etc. | MovieWeb Rating |

Film Title | Release Date |

Producer | Earlier Film Version Date |

Earlier Film Box Office $ million |

| 2.8 | I am Number 4 | 2/19/11 | DreamWorks | None | None |

| 4.9 | Thor | 5/6/11 | Paramount Marvel | None | None |

| 4.8 | Pirates of the Caribbean – Tides | 5/20/11 | Disney | 2007 | 960 |

| 4.7 | Kung Fu Panda | 5/26/11 | DreamWorks | 2008 | 631 |

| 4.4 | X-Men First Class | 6/3/11 | 20th Century Marvel |

2009 | 373 |

| 4.6 | Cars II | 6/24/11 | Disney | 2006 | 461 |

| 4.9 | Captain America | 7/22/11 | Paramount Marvel |

None | None |

| 4.1 | Red Steel | 10/7/11 | Disney | None | None |

| 3.8 | Shrek PussNBoots | 11/4/11 | DreamWorks | 2010 | 747 |

| N/A | The Muppets | 11/23/11 | Pixar | 1999 | 22 |

| 4.0 | The Adventures of TinTin | 12/23/11 | DreamWorks | None | None |

Clearly, Disney and its associates have a more potent movie offering than Warner in 2011 and all predictions are that Disney, not Warner, will lead the pack in terms of box office Dollars this year. As there is a clear correlation between ticker sales and subsequent DVD sales, I predict that again in this instance Disney will win in 2011.

Clearly, Disney and its associates have a more potent movie offering than Warner in 2011 and all predictions are that Disney, not Warner, will lead the pack in terms of box office Dollars this year. As there is a clear correlation between ticker sales and subsequent DVD sales, I predict that again in this instance Disney will win in 2011.

Copyright © 2024 TDmonthly®, a division of TOYDIRECTORY.com®,

Inc.