December 29, 2025

January 2011 | Vol. X - No. 1

Toy Market 4Q and 2011

The toy space in the fourth quarter 2010 was an interesting place. One upside factor was online toy sales which, to judge what I hear from friends in the industry, were up by some 10%. Brick-and-mortar toy sales, according to NPD, were for the first nine months up 1% but my retailer panel data suggests that the last quarter was flat. In fact both October and November were up marginally but December fell short in comparison to last year. Remember, December 2009 toy sales were surprisingly strong, particularly in the second half of the month. In 2010, there was a second rush but it was one week later and weaker than the year before. This was not helped by the monster storm that hit the Eastern Seaboard on Christmas Day and effectively shut down a good part of the country on December 26, a shopping day second only to Black Friday.

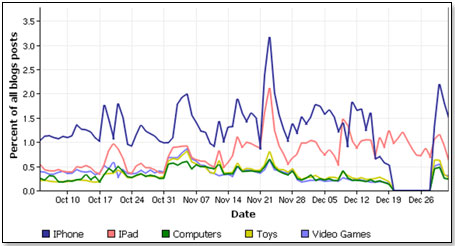

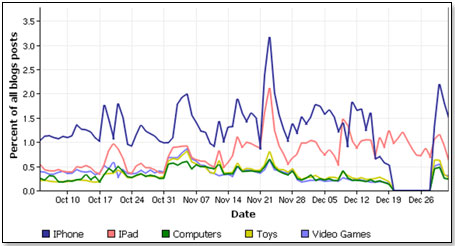

This is demonstrated by the blog activity governing the main categories. It looks as if they all fell off a cliff – excepting the IPad which defied this trend - just before Christmas and only recovered just before the end of the year:

This is how the various product categories fared in December according to the Klosters retailer panel:

Action Figures: down. While December 2009 still felt the positive after effects of the Transformer and G I Joe movies, there was no such echo in 2010. Of all action figures, Star Wars [Hasbro] performed best, followed by WWE [Mattel].

Dolls: up. December was driven by Disney Princess [Mattel and Jakks] which was up very sharply all year. The Tangled movie lent further impetus to this trend.

Construction: up. Lego continues to grow very rapidly and is pulling the entire category up with it.

Infant and Preschool: up. Toy Story 3 [mainly Mattel’s Fisher Price] continued to strengthen the entire category with Thomas Friends [Mattel] and Chuggington [RC2] lending support.

Games and Puzzles: down. Lego’s entry into the field continues to gain strength and Mattel is also gaining market share. Hasbro as the market leader not only lost share and also sales dollars because of its ongoing very heavy discounting program.

Vehicles: up. Both Hot Wheels and Cars [both Mattel] performed well.

Arts and Crafts: up. Crayola [Hallmark] and to a lesser degree Elmer’s [Berwind Corp] are dominating the category and both excel at in-store placement

All Others: down.

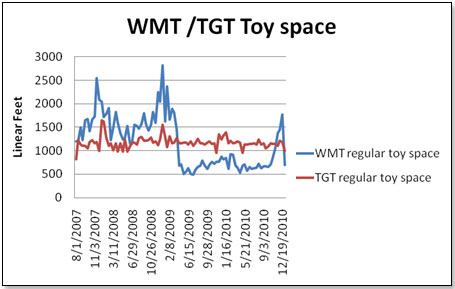

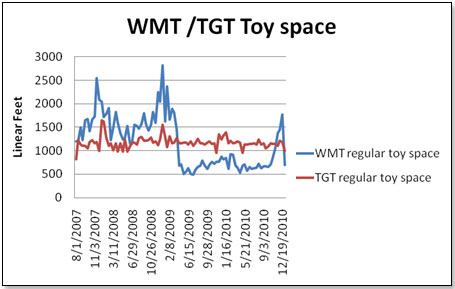

December was characterized by Wal-Mart’s return to the toy aisle. This is how their toy space expanded and then again contracted in comparison to Target [up to January 1. 2011 as per the Klosters retailer panel]:

While Target kept its toy space pretty much on even keel, ToysRus expanded its overall toy space in November and December by approx 20%: by using Pop-up stores, FAO stores and additional aisle caps in their regular stores. Just like Wal-Mart, TRU has also begun to contract its toy space by putting the contents of all its pop-up stores on clearance with the goal of shutting them by end of January 2011.

While this expansion in shelf space clearly helped toy manufacturers in terms of their fourth quarter shipments, this was not matched by an equal increase in sell-through. The toys now occupying these shelves will still be around when the space reverts to other product categories and this will result in much higher end-year retail inventory levels compared to last year. In fact, at the end of 2009, inventories were extremely low and this resulted in a very much higher than normal generation of retailer purchase orders and inordinately low clearance activity for the first quarter of 2010. In 2010, the converse was the case. Inventory levels will be higher than what the retailers like and the buyers will have to work them down. This they will do in two ways – they will issue much lower Purchase orders than would normally be the case, and they will allocate a high percentage of their remaining toy space to clearance sales. This has already begun to happen at all three majors.

As for the outlook for the first quarter and beyond, the large toy retailers are somewhat pessimistic for the first quarter but more optimistic for the remainder of next year. In this, they are influenced by a number of economic factors but also, at least for the short term, by what they perceive to be the consumer confidence level. This has taken a turn for the worse, probably fuelled by high persistent unemployment and high gasoline prices:

In 2009 at the same time, buyers looked at very low toy inventories and growing consumer confidence levels and both led to high order activity for the first quarter. In 2010, neither applies.

As for the rest of the year, the retailers are more upbeat. They look at the normal toy drivers – movies – and believe that the picture is very positive for the large product categories.

For Action Figures, they see a very strong movie line-up with Thor, Transformers and Captain America being the main drivers. There are also the Pirates, Harry Potter and Green Lantern. This is where Hasbro will excel.

The Construction category has the same drivers as Action Figures and both Lego and Mega should have a good year as a result.

Preschool also has good support – Kung Fu Panda, Smurfs and Winnie the Pooh ensuring that both Mattel and Jakks are performing well in this category.

As for Vehicles, the next CARS sequel will hit the big screen in June and this will benefit Mattel, who has the toy master license.

Dolls have only one supporting film – Disney’s Beauty and the Beast – as compared to Alice and Tangled in 2010. However, Tangled is expected to have an impact for most of the first half of 2011 and the two movies between them will ensure that the category will perform nicely, particularly for Disney Princess.

Of the major companies, Hasbro is likely to have the best growth rates for a number of reasons. Firstly, the films supporting the action figures program are going to propel their second-most important product group nicely upwards, Secondly, The Hub is expected to become a significant force in the toy space in the third quarter of 2011 and beyond . Thirdly, their deal with Turner Broadcasting/Discovery Channel is likely to spur growth in their international business. Games and Puzzles, their largest category, is likely to remain under pressure given Lego’s increasing market share both in international and in the United States and also looking at Mattel’s growing importance in this field. Preschool will benefit greatly from the addition of Sesame which will migrate from Mattel to Hasbro as of January 1. Their Girl category will have a fight on its hands since Disney Princess is clearly making inroads into Strawberry Shortcake.

Mattel is also expected to do well – firstly because of the 6 films screening this year and supporting three major product categories – Dolls, Preschool and Vehicles. The departure of Sesame will set them back a bit but Thomas is getting good traction and will offset this loss at least partially. Disney Princess will continue to do fantastically well but will make inroads into Barbie who is already now again losing market share. The Bratz/Barbie fight will again resume in January but I wonder why Mattel bothers. Bratz today is only a shadow of its former self and the general betting is that the doll consumers, the young girls, have moved on. Monsters dolls are gaining traction and expected to gain further momentum next year. They are expected to do well in the games category particularly in the light of the two recent acquisitions – Phase 10 and Imaginiff.

Lego is also expected to do well for two main reasons. One, its construction business will have the same benefit of film support Hasbro has for its action figure program. Secondly, its board game entry is expected to continue to move forward both in international as well as in the United States.

Spin Master rounds out the array of the winners. Spin Master has very quietly racked up above-average growth rates over the past five years and is now the third-largest North American toy manufacturer after Mattel and Hasbro. They also have in 2010 for the first time had a crack at major toy licenses from the side of Dream Works [How to train a Dragon], Paramount [Last Air Bender] and Disney [Tron Legacy]. I would be surprised if another major film deal was not in the works for 2011. If it is not, then 2011 could prove to be a challenge because their growth rates will begin to flatten without a major driver. There is just so much market share you can get in the toy space without major licenses and I think that Spin Master has reached that point.

If you have the five largest toy manufacturers expected to rack up above-average growth rates between them then something will have to give and this is likely to be all the other second-tier companies such as Jakks, RC2 etc. 2011 is likely to be a very trying year for them.

Copyright © 2025 TDmonthly®, a division of TOYDIRECTORY.com®,

Inc.