April 2, 2025

| “ … it is important for any toy marketer to know what movies are coming down the pike, who the licensees are, and what buyers are thinking of the movie as a toy driver.” |

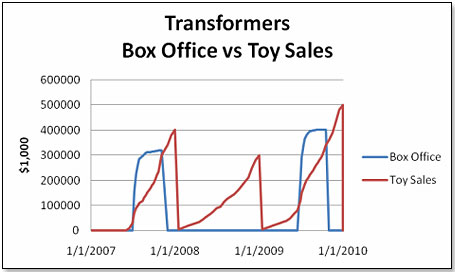

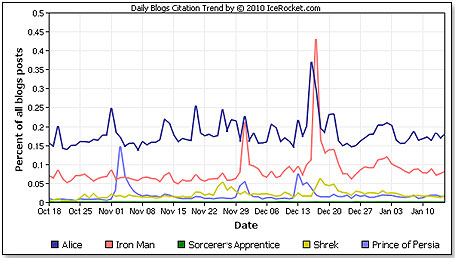

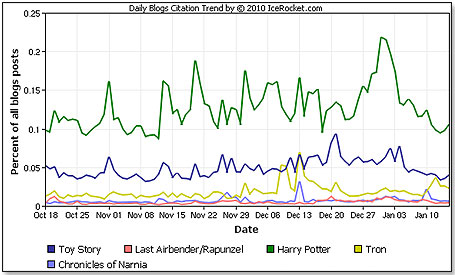

This resonancy factor is a major benefit for the toys that carry the license. While the box office sales of the movie tend to sharply diminish after the first week, the benefit to the toy products tends to kick in well before the movie is shown and also tends to last much longer. Here, we have a declining slope that increases over time, but the decline is much gentler and the benefits last much longer.

This resonancy factor is a major benefit for the toys that carry the license. While the box office sales of the movie tend to sharply diminish after the first week, the benefit to the toy products tends to kick in well before the movie is shown and also tends to last much longer. Here, we have a declining slope that increases over time, but the decline is much gentler and the benefits last much longer.

| Producer | Title | Release Date | Rank | Toy Licen- see |

Second Licen- see |

Box Office Last Movie* |

Release Date |

| Disney | Alice in Wonder- land |

3/5/10 | 7 | Mattel | Medicom | n/a | 1951 |

| Hasbro | Iron Man 2 | 5/7/10 | 4 | Hasbro | Mega Brands | $228.6 M |

2008 |

| Disney | The Sorcerer's Apprentice | 5/16/10 | 11 | None | None | None | None |

| Dream Works | Shrek Forever After | 5/21/10 | 1 | Playmates (N. America); Vivid (Int'l) | Lego | $307.8 M |

2007 |

| Disney | Prince of Persia: The Sands of Time | 5/28/10 | 5 | McFarlane | Lego | None | None |

| Disney | Toy Story 3 | 6/18/10 | 2 | Mattel; Thinkaway Toys | Lego | $208.8 M |

2009 |

| Para- mount |

The Last Airbender | 7/2/10 | 9 | Spin Master Toys | None | None | None |

| Warner | Harry Potter and the Deathly Hollows | 11/19/10 | 3 | Tomy (Int'l); NECA (N. America) | Lego | $294.2 M |

2009 |

| Disney | Rapunzel | 12/1/10 | 8 | Mattel | Lego | None | None |

| Disney | Tron Legacy | 12/17/10 | 10 | Spin Master Toys | Lego | $33 M | 1982 |

| Fox | The Chronicles of Narnia: The Voyage of the Dawn Treader | 12/17/10 | 6 | Jakks Pacific | None | $135.5 M |

2008 |

| Producer | Title | Release Date | Rank | Toy Licen- see |

Second Licen- see |

Box Office Last Movie* | Release Date | |

| Warner Bros. | Jack the Giant Killer | 2011 | 13 | ? | ? | ? | 1962 | |

| Marvel | Thor | 5/6/11 | 5 | Hasbro | ? | None | None | |

| Warner Bros. | Green Lantern | 6/17/11 | 10 | Mattel | None | None | ||

| Paramount | The Adventures of Tintin: The Secret of the Unicorn | 6/23/11 | 8 | ? | ? | None | None | |

| Disney | Cars 2 | 6/24/11 | 6 | Mattel | Lego | $220.0 M |

2006 | |

| Disney | Pirates of the Caribbean: On Stranger Tides | 7/1/11 | 3 | Lego | $301.7 M |

2007 | ||

| Hasbro | Transfor- mers 3 |

7/1/11 | 1 | Hasbro | $393.7 M |

2009 | ||

| Warner Bros. | Harry Potter and the Deathly Hollows: Part II | 7/15/11 | 4 | Tomy; NECA | Lego | $294.2 M |

2009 | |

| Disney | The Smurfs | 7/29/11 | 11 | Jakks Pacific | $11.2 M |

1983 | ||

| MGM | The Hobbit: Part 1 | 12/1/11 | 2 | ? | Lego | $345.3 M |

2003 | |

| Disney | The Bear and the Bow | 12/24/11 | 12 | Mattel | None | None | ||

Copyright © 2025 TDmonthly®, a division of TOYDIRECTORY.com®,

Inc.