April 2, 2025

July 2009 | Vol. VIII - No. 7

The House That JAKKS Built

Master Toy Acquisitor Maintains Strong Distribution With Big Retailers

| “The three top executives spend most of their time acquiring companies and integrating them with a very clear focus on generating the highest possible level of cost synergies.” |

Tuesday, July 7 – The year 2009 will probably be remembered as the year in which the U.S. toy market underwent a structural change. I hear more and more often that the big retailers are looking upon the toy department as a necessary evil and a loser over the longer haul. I also see that Wal-Mart is cutting down on space devoted to toys and hear that other major retailers are debating the wisdom of following a similar strategy. There is also talk of new approaches being contemplated or implemented in which they gradually shift toward a mix of strong toy brands that are heavily promoted by the manufacturers on one side and non-promoted private-label products attractive only by dint of low prices — with very little in-between.

At the same time, we see an expanding effort by large toy companies — notably Hasbro, Giochi Preziosi and Lego — to strengthen their brands and leverage them into major entertainment avenues, such as video games, movies, television and the Internet, in order to dilute the influence exerted by large retailers over consumer choices. This strategy is not only designed to multiply the avenues by which brands are brought to consumers, but it also protects the same brands and their margins at the large retailers. In short, it attempts to shift control back to the manufacturers who lost it to Wal-Mart and its peers at the beginning of this decade.

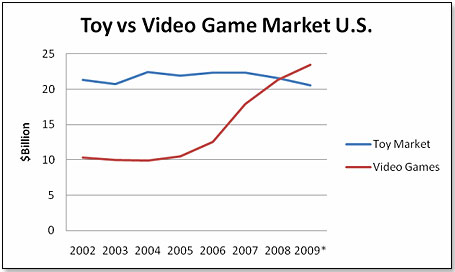

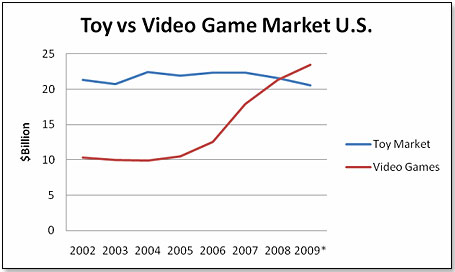

These re-assessments are prompted by the fact that the toy market in the United States is not going anywhere. This is what both retailers and manufacturers see when they look at the category:

*Estimate; Source: TIA

It’s no surprise that Wal-Mart, for one, considers the toy market a loser and video games an area worthy of support.

It is interesting to see how various major toy manufacturers are beginning to position themselves in this year of change, and I have come to the conclusion that if Hasbro represents one extreme, JAKKS Pacific represents the other. This view is shared by a number of buyers as well as executives at JAKKS’ competitors, whom I consulted when writing this article.

JAKKS Pacific has two major skills:

1. They know how to acquire companies cheaply and are unsurpassed in getting distribution with major toy retailers.

2. They are very good at implementing supply chain innovations and have not had any of the recalls that beset a number of their competitors recently.

Typically, JAKKS grows by buying companies. The three top executives spend most of their time acquiring companies and integrating them with a very clear focus on generating the highest possible level of cost synergies. Once this is done, they delegate the daily business to their lieutenants and move on to the next license or next acquisition. The result is that these acquired companies typically have an initial growth burst and then stagnate, hence forcing the top guys to find another acquisition to ensure company growth.

The roster of JAKKS’ acquisitions is impressive:

| Date Acquired |

Company name |

Company Business |

Yearly Sales Volume before Acquisition |

| 9/23/1999 |

Flying Colors |

Activity Kits |

$54 million |

| 7/31/2000 |

Pentech |

Stationery, Activity Kits |

$99 million |

| 10/28/2002 |

Toy Max |

Toys |

$132 million |

| 6/14/2004 |

Play Along |

Toys |

$160 million |

| 6/14/2005 |

Pet Pals |

Veterinary Toys |

$5 million |

| 2/12/2006 |

Creative Designs |

Toys |

$142 million |

| 10/13/2008 |

Kids Only/Tolly Tots |

Toys |

$30 million |

| 1/9/2009 |

Disguise |

Toys [Halloween] |

$106 million |

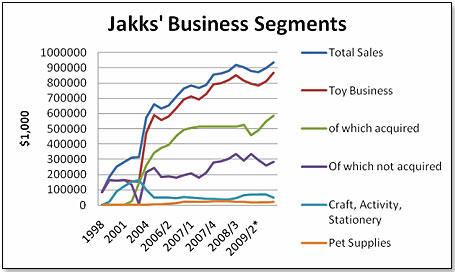

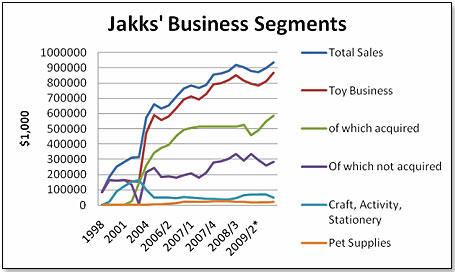

I analyzed their business from this angle, separating out the “acquired” business versus the “not acquired” toy business. The latter includes any new licenses obtained outside their acquisitions. The numbers are in $1000 moving annual totals:

*Estimates; Source: JAKKS’ SEC filings

This graph suggests that business for JAKKS Pacific would be pretty much static were it not for the regular addition of new acquisitions. This is not only demonstrated by the toy curves themselves but also by those applicable to the Craft, Activity and Stationery segment and the Pet Supplies segment. Both segments were acquired but then not augmented by further acquisitions. The result was no growth.

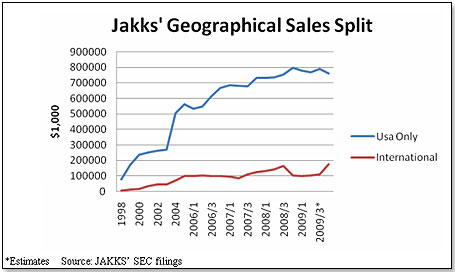

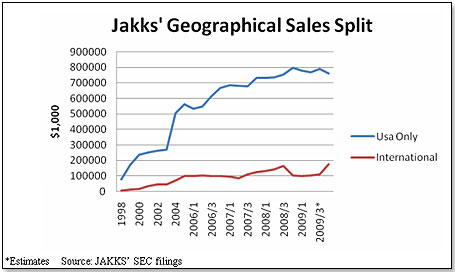

Not only has its business not grown organically; JAKKS has also not been able to make meaningful inroads into the non-U.S. toy market, which represents about 70 percent of the world total. The numbers are again in $1000 moving annual totals:

*Estimates; Source: JAKKS’ SEC filings

While its inability to grow organically does not seem to worry JAKKS management too much — because, after all, their business is growing and profitable because of their acquisition policies — it does tend to worry licensors. JAKKS lost Care Bears to Mattel this year and will lose next year the WWE action figure license to Mattel as well. In addition, it now appears that the Joint Venture with THQ exploiting the WWE video game franchise is also going west by the end of 2009. This is a big deal because JAKKS made from this Joint Venture $17 million in pure profit in 2008, which represented nearly 20 percent of its total net income before taxes that year.

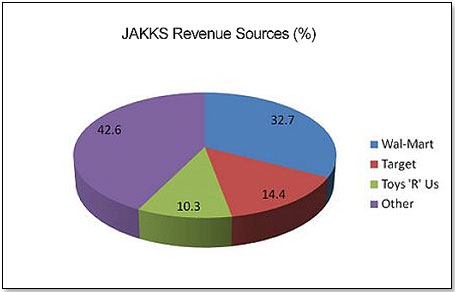

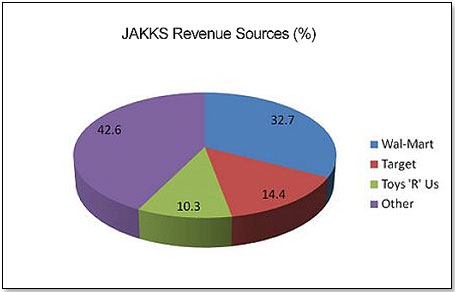

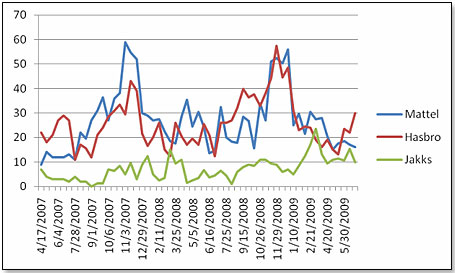

What is also worrying people inside and outside the company is JAKKS’ increasing reliance on Wal-Mart. Saj Karsan, in his article “Wal-Mart Could Put the Squeeze on JAKKS Pacific” in the June 23, 2009, issue of “Seeking Alpha,” pointed out the inordinate share Wal-Mart has in JAKKS business:

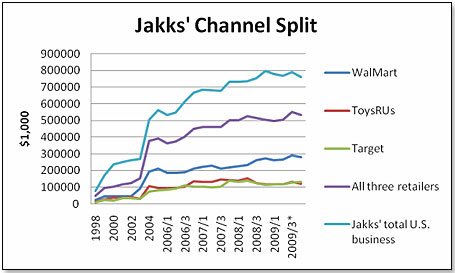

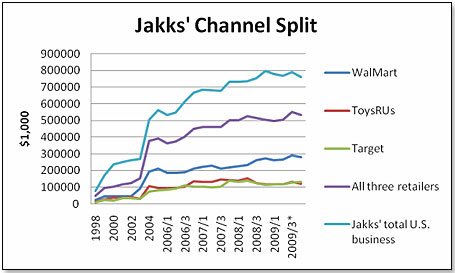

This is how JAKKS’ business with the three major toy retailers has evolved — in $1000 moving annual totals:

*Estimates; Source: JAKKS’ SEC filings

And this is how the three majors participate in JAKKS’ U.S. business as of this year:

| Rank |

Retailer |

U.S. Toy Market Share |

Share of JAKKS' U.S. Business |

| 1 |

Wal-Mart/Sams |

30% |

37% |

| 2 |

Toys "R" Us |

16% |

16% |

| 3 |

Target |

14% |

18% |

This dependence on Wal-Mart could be fraught in light of recent developments suggesting the retailer is significantly cutting back on its toy space.

JAKKS is moving fairly forcefully to make up for its lost licenses. Specifically, JAKKS got two new brands to replace the WWE action figure franchise with effect from January 2010 — UFC and TNA. Both, together, have reasonable potential, and the former is further strengthened by the smashing success of the UFC 2009 Undisputed video game [No. 1 in June in the USA and No. 5 in Europe].

JAKKS also got the right for the Slinky for sale outside the United States, and this should help JAKKS in its effort to build a much stronger international presence.

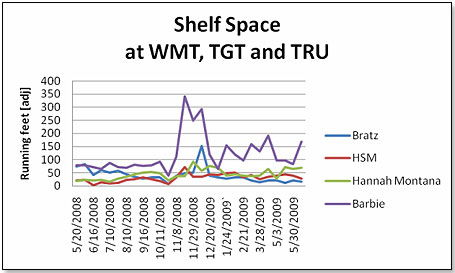

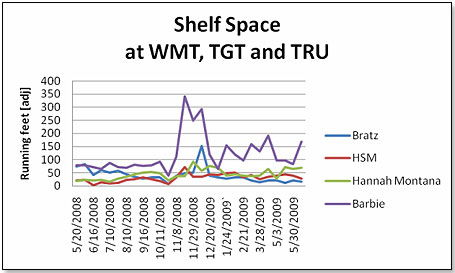

The company is also building brands, specifically two: Hannah Montana and Club Penguin. Hannah Montana is in direct competition with the venerable Barbie and is holding its own on the strength of the movie, good merchandising and good displays. This is how Hannah Montana’s shelf space compares to its competitors at Wal-Mart, Target and Toys “R” Us:

Source: Retailer Panel, Klosters Trading Corp.

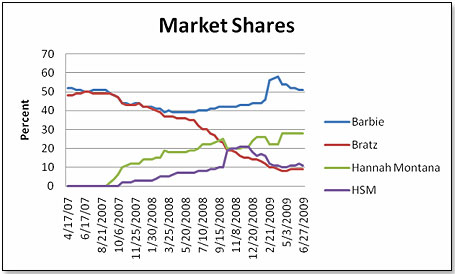

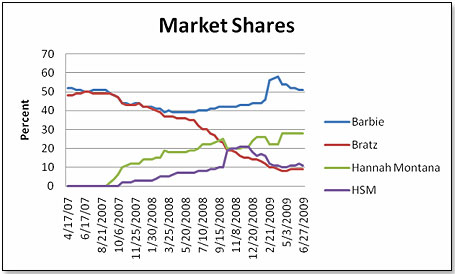

In short, Hannah Montana has about half the shelf space of Barbie and about double that of High School Musical and Bratz. This is also reflected in the market shares of these four brands in these retailers:

Source: Retailer Panel, Klosters Trading Corp.

As for Club Penguin, this is the only major brand in the world of virtual playgrounds that is gaining market share. This is in no small part due to JAKKS’ efforts in merchandising the brand particularly at Toys “R” Us.

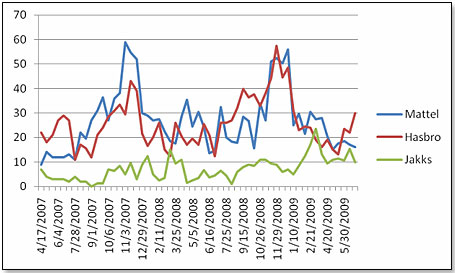

Speaking of merchandising, JAKKS has of late become very aggressive in exploiting the opportunities inherent in endcaps and aisle caps at large toy retailers. This is how JAKKS compares with Mattel and Hasbro, companies who have three and four times JAKKS’ U.S. sales volume:

Source: Retailer Panel, Klosters Trading Corp.

One of these endcaps at Toys “R” Us carries Disguise, a product range acquired by JAKKS earlier this year. Disguise competes with Rubies, which claims to be the largest Halloween and masquerade products manufacturer and distributor in the world. I checked how far JAKKS had come in placing Disguise products in the three large retailers since the acquisition six months ago and compared its presence with that of Rubies’ on the same day in the same places:

| |

Rubies No. of SKUs |

Disguise No. of SKUs |

Wal-Mart

On Shelf |

None |

None |

Wal-Mart

Online |

1 |

None |

Target

On Shelf |

None |

None |

Target

Onine |

2 |

69 |

Toys "R" Us

On Shelf |

5 |

45 |

Toys "R" Us

Online |

71 |

3 |

Source: Retailer Panel, Klosters Trading Corp.

I would call this pretty even overall, which is an excellent performance from the side of JAKKS given that it only had six months to erase the distribution advantage Rubies accumulated in the several decades when it was the only kid on the block.

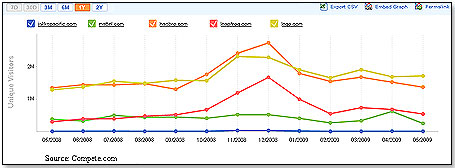

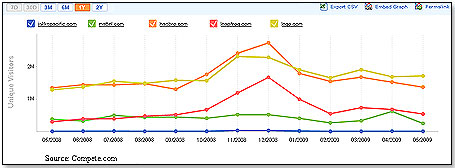

Yet, while JAKKS indisputably is doing an outstanding job in securing and maintaining its strong position with the large retailers, it totally removes itself from any avenue that might represent an alternative in case things go wrong on the brick-and-mortar front. JAKKS has a joint venture with THQ in the video game space but is not at all involved in it or trying to leverage its brands into this area. It is not venturing into any of the other entertainment areas that are being so forcefully exploited by Hasbro. And as far as the Internet is concerned, its Web traffic tells the story:

Source: Compete.com

In short, it looks as if JAKKS is purposefully avoiding any activity that could detract from its admittedly very strong relationships with the large retailers. It is a strategy that appears to totally align the interests of JAKKS with those of the three big discounters. Looking at the company performance over the past 12 years, the strategy has worked, and JAKKS management can be excused for feeling pretty good about it. Whether this will continue to be the case is at this stage unknown, but some very savvy toy corporations are betting that things are changing in a very fundamental way.

Copyright © 2025 TDmonthly®, a division of TOYDIRECTORY.com®,

Inc.