January 5, 2026

June 2008 | Vol. VII - No. 6

How Wal-Mart’s Beating Target at Toy Placement

Mass Retailers’ Response to Inflation Plays Out in the Aisles

| “Wal-Mart and Target have allocated about one-third more total space to the toy department than they did a year ago.” |

It is now pretty clear that we are looking at the worst year this century for the U.S. toy market. Why? Three reasons: gasoline prices, housing implosion and run-away inflation. We all know about the first two, but the third deserves a closer look.

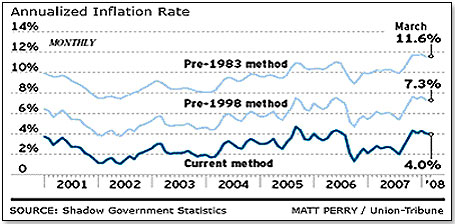

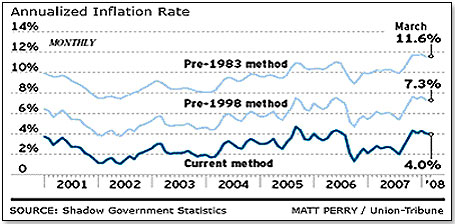

Financial writer Graham Summers said that if we were to apply the same criteria to inflation measurement as was applied 30 years ago, the rate of inflation would not be 4 percent but rather three times that amount:

My retailer panel sell-through data suggests that the U.S. toy market dropped by about 6 percent for the first four months of 2008. May was worse, as sales dropped by 7 percent for the month compared to last year.

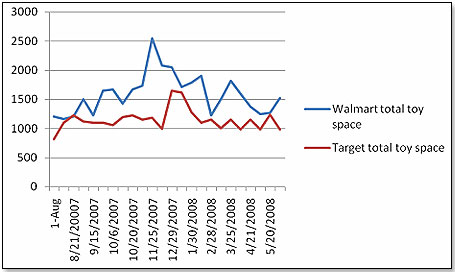

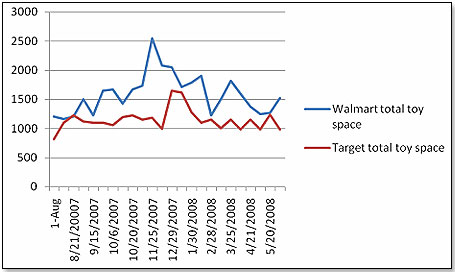

How are the mass retailers — particularly Wal-Mart and Target — reacting to this? A good way to judge their strategy is to look at how much space they allocate to the toy department. Note that the graph below measures shelf space as well as end and aisle caps — the latter two at a formula that takes into account their higher sales velocity, including the upsides of checkout locations:

Both Wal-Mart and Target have allocated about one-third more total space to the toy department than they did a year ago, and this graph tells us that Target has been pretty much level since the beginning of March, whereas Wal-Mart is now sharply trending upwards.

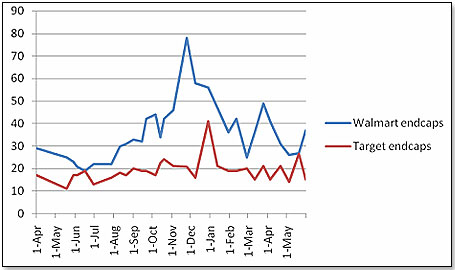

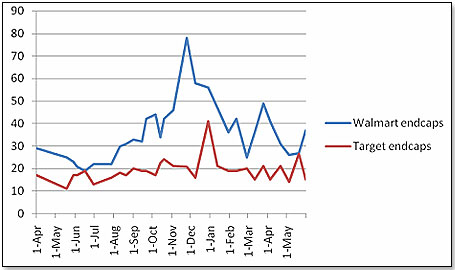

Looking at endcaps and aisle caps in isolation is instructive:

Here we see a slightly different pattern. At the beginning of June last year, toy space allocation for the two retailers was identical. After this, Wal-Mart trended sharply upward with a peak at the beginning of December. Target, however, stayed level until year end and then had a very sharp peak in January because of price reductions and clearances. The most recent point of the line, which is May 31, shows a repeat of the same: Wal-Mart beginning to trend upward and Target staying level.

We know what happened in 2007 during the last four months of the year. Wal-Mart drove consumers into their stores on the basis of very aggressive toy promotions and price reductions. It also had a 2.4-percent increase in same-store sales. Target followed a much more conservative approach and had negative same-store sales numbers — down 5 percent..

We know what happened in 2007 during the last four months of the year. Wal-Mart drove consumers into their stores on the basis of very aggressive toy promotions and price reductions. It also had a 2.4-percent increase in same-store sales. Target followed a much more conservative approach and had negative same-store sales numbers — down 5 percent..

Having talked to my friends at Wal-Mart and Target, I hence predict two things. One is that we shall see again very aggressive toy promotions from the side of Wal-Mart commencing toward the end of the third quarter, just as we did last year. The second is that Target will also ramp up its toy department in the coming months and match Wal-Mart dollar for dollar.

Having talked to my friends at Wal-Mart and Target, I hence predict two things. One is that we shall see again very aggressive toy promotions from the side of Wal-Mart commencing toward the end of the third quarter, just as we did last year. The second is that Target will also ramp up its toy department in the coming months and match Wal-Mart dollar for dollar.

Both developments have both good and bad consequences for toy manufacturers. There will be more shelf space for toys and hence more opportunities to get products into both retailers. But, this will require greater pricing and margin sacrifices. This last point is particularly tough this year, as the yuan is revaluing, inflation in China is skyrocketing, and shipping costs are rising in line with oil prices.

Copyright © 2026 TDmonthly®, a division of TOYDIRECTORY.com®,

Inc.

We know what happened in 2007 during the last four months of the year. Wal-Mart drove consumers into their stores on the basis of very aggressive toy promotions and price reductions. It also had a 2.4-percent increase in same-store sales. Target followed a much more conservative approach and had negative same-store sales numbers — down 5 percent..

We know what happened in 2007 during the last four months of the year. Wal-Mart drove consumers into their stores on the basis of very aggressive toy promotions and price reductions. It also had a 2.4-percent increase in same-store sales. Target followed a much more conservative approach and had negative same-store sales numbers — down 5 percent..  Having talked to my friends at Wal-Mart and Target, I hence predict two things. One is that we shall see again very aggressive toy promotions from the side of Wal-Mart commencing toward the end of the third quarter, just as we did last year. The second is that Target will also ramp up its toy department in the coming months and match Wal-Mart dollar for dollar.

Having talked to my friends at Wal-Mart and Target, I hence predict two things. One is that we shall see again very aggressive toy promotions from the side of Wal-Mart commencing toward the end of the third quarter, just as we did last year. The second is that Target will also ramp up its toy department in the coming months and match Wal-Mart dollar for dollar.