|

Tools:

Spin Master – an interesting performance

While Spin Master had a very choppy performance in the fourth quarter and would have been in negative territory had it not been for the Cardinal acquisition, the management explained this by saying that they had this year shipped the bulk of their fourth quarter purchase orders early – in September this year as opposed to October last year. In fact, their numbers look much better if you factor in this change.

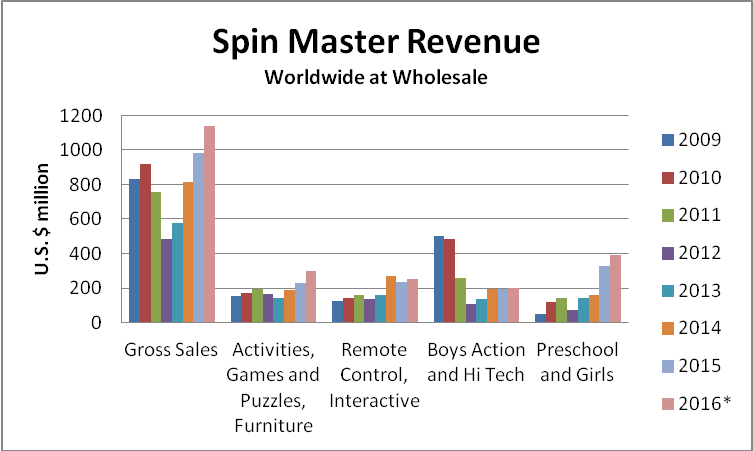

This is how their individual categories, and their gross revenue totals, performed since 2009 and projected forward to the end of this year [on the basis of sell-through numbers up to March 31]:

Source: Spin Master Financial Reports

However, if you look more closely, the company did very well only in one category – Preschool and Girls – and this because of one IP only: Paw Patrol. Remote Control and Interactive was negative, below last year by 13%. Activities, Games, Puzzles and Fun Furniture excluding Cardinal were up by 4% which is significantly below market growth whereas Boys Action Figures and Hi-Tech Construction was flat despite Spin Master’s secondary Star Wars licenses and the Meccano expansion.

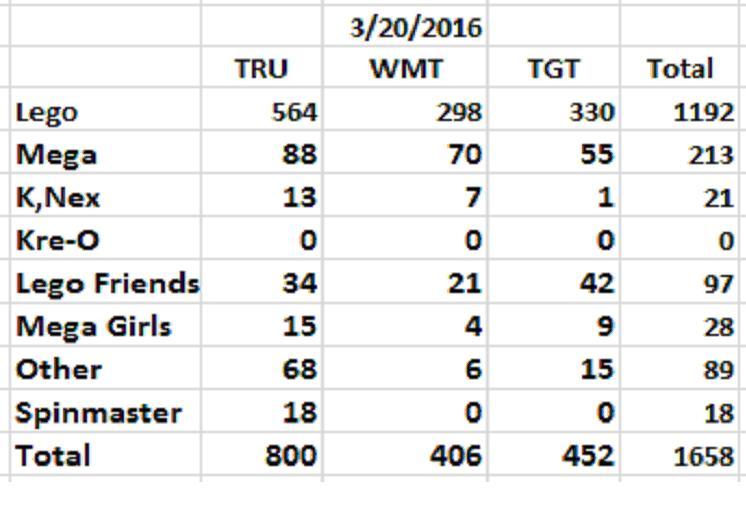

Meccano, bought by Spin Master, in 2013, has had some progress in the United States but remains a very marginal player, as is borne out by the most recent shelf space readings of the stores surveyed late March:

Source: Klosters Retailer Panel

In fact, Meccano is clearly in the gun sights of Mega whose expansion strategy it is not to tackle Lego head-on but rather to first pick up the low hanging fruit – the products accounting for about 15% of the market not taken by either Lego or Mega – by simply shoving them off retailer shelves. Meccano is in the eyes of Mattel part of this low hanging fruit category and hence a target of Mega’s shelf expansion efforts.

On the positive side, Paw Patrol is a phenomenon backed by Spin Master’s own TV series run on Nickelodeon since 2013. The company is trying to leverage the brand from Preschool to other toy categories and is definitely making progress in this effort. Given the brand’s current momentum, there is little doubt that it will continue to outperform the category and the toy market overall.

The company is also making progress in its endeavour to enlarge its international footprint. Their numbers are impressive on the surface – in 2015 they grew nearly 36% in Europe and about 20% elsewhere and this without including Cardinal in their numbers. This does not mean that they are at this point a major force outside North America – International today accounts for only about 12% of their worldwide sales whereas the two leading U.S. toy companies, Hasbro and Mattel, have both solidly north of 40% of their sales there. Cardinal will not alter this equation, at least not in the short term, as the company has virtually no distribution outside North America. In summary, Spin Master’s now has an estimated international market share of less than 0.5% and this will not materially change unless the company makes a major acquisition in this direction.

Yes, the company has been on an acquisition binge of late, of sorts, in that they bought this year the Etch A Sketch product line from Ohio Art and also acquired the Italian Editrice Giochi company. Neither is a game changer and both have worldwide sales of less than $10 million. The rationale for the Editrice acquisition is reasonably clear – it marginally strengthens Spin Master’s games portfolio and it gives it a marginal stake in Italy where the company has so far not been a factor. The rationale for the Etch A Sketch acquisition is less clear. Etch A Sketch does not have a synergistic effect on any of Spin Master’s four product categories. Also, the line is not a factor in Europe and hence does not enhance Spin Master’s international footprint. Unless Spin Master manages to infuse technical innovation into this very old product Etch A Sketch will remain marginal.

The company also announced their intention to relaunch Bakugan, the Japanese action figure range owned by Spin Master. Bakugan was a factor in the Action Figure category between 2008 and 2012 and, according to the company, generated gross sales in the neighbourhood of US$ 800 million. The product range was backed by a television series produced by TMS Entertainment and Japan Vistec and which was on air between February 2008 and May 2010 . The product licenses were held by Spin Master and Sega Toys and sales hit their high watermark in 2009 and fell off a cliff by end of 2011. If in fact Spin Master decides to proceed with Bakugan it is assumed that they will also fund the film development and the media exposure similar to what they are now doing with Paw Patrol.

Very significantly, Spin Master had a good Toy Fair this year. According to the national buyers who shared their notes with me, the company has begun to put much more emphasis on two areas of their portfolio – movie licenses and hi-tech products. For the former, they are featuring Star Trek, Batman vs Superman, Star Wars and Angry Birds – all under secondary licenses from Hasbro and Mattel. For the latter, the Zoomer Robot Chimp was probably the most interesting one. There were also Air Hogs drones, Meccano products such as the Meccanoid robot, and programmable Micronoids.

The buyers came away from Spin Master’s Toy Fair presentation with the sense that the company was becoming more focused in its product strategy and hence more of a real factor in the toy space.

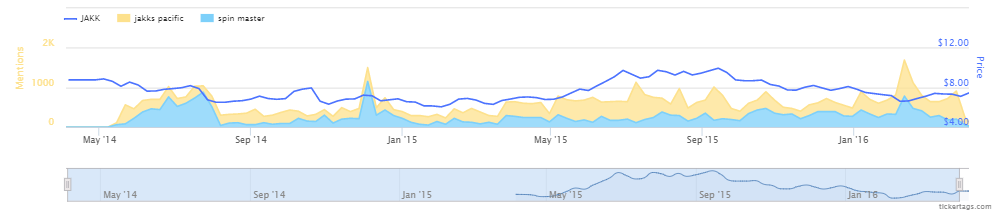

However, this does not change the fact that Spin Master continues to be regarded as second tier by the buyers. In many ways they perceive the company to be similar to Jakks Pacific who, as Spin Master, is not a leader in any particular toy category, who relies on secondary licenses for its forward momentum, and whose overall marketing effort is opportunistic as opposed to strategic in nature. They are also aware of the fact that Jakks Pacific has a greater consumer following than Spin Master, despite of the fact that Jakks’ sales are significantly lower. This is best demonstrated by the social media traffic for the two companies:

Source: Ticker Tags

In summary, Spin Master has clearly progressed in the past twelve months and is likely to continue doing so during the next twelve. However, this does not address the basic weakness in its model of being Jack(s) of all trades and master of none.

Writer's Bio: Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author

THIS BANNER IS AN AD:

Back to TDmonthly's front page

|  |

Advertise on TDmonthly

|