|

Tools:

Will Thomas the Train Rescue Mega Brands?Competition Is Keen, But New Licenses Hold Promise

| “While things are clearly going better, the company is not quite out of the woods yet.” |

Lutz Muller is an industry analyst who shares opinions and makes market projections based on public and confidential research, including interviews with contacts at major U.S. retailers.

Mega Brands has for the first time in years had two consecutive growth quarters in their toy sector. This comes after a grim struggle to get out of the hole dug by their RoseArt acquisition back in 2005 and the subsequent recalls of Magnetix. The change signals the return to long-term growth and profitability.

Get the Flash Player to see this video.

WATCH VIDEO summarizing

this article's conclusions.

While things are clearly going better, the company is not quite out of the woods yet. Their first half this year was driven by Iron Man 2, a movie that was expected to do box office numbers in line with other record breakers and was firmly believed to generate significant toy sales. Neither materialized. Yes, Iron Man 2 was a strong movie but not in the same street as Transformers 2, or Star Wars – Revenge of the Sith, or Batman Dark Knight. The result of a weaker-than-anticipated movie was weaker-than-anticipated sell-through of the toy products on the shelves. This is likely to affect Mega’s performance in the third and fourth quarters because excess inventory will have to be flushed through the channel before new shipments can take place.

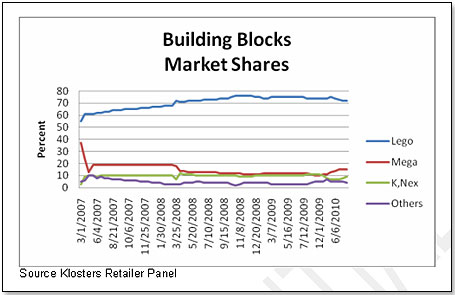

Their toy sales for the first six months of the year were 33 percent above the same period last year. and they have of late gained market share over the past twelve months as per the sell-through numbers of my retailer panel over time:

However, competition is growing as well. During the first half of this year, LEGO was up in local currencies by 34 percent. Best-Lock is also growing rapidly as explained by their VP Global Sales, Stephen Minsk:

“Best-Lock is undoubtedly gaining market share. (Perhaps the most of all the 3 companies). Our worldwide sales in 2010 are at record levels and should hit a 40%+ gain over 2009 numbers. Best-Lock has expanded into many more retail outlets this year and made significant gains in Canada as well as in the US market. We do what we always did in the past, which is to offer a full range of great value products with good retailer margins. Our model designs improved a lot this year and will continue to do so as well as big improvements in the packaging.”

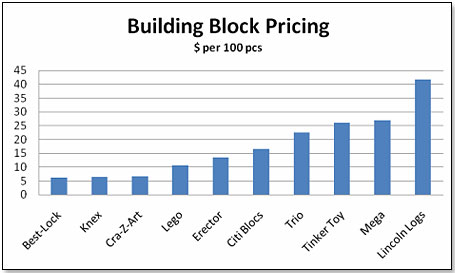

LEGO and Best-Lock are not Mega Brands’ only competitors. The first metric to look at is retail pricing:

Taken from Amazon, top ten products each company, dropping out the most expensive and the lowest priced product for each.

This shows that Mega’s products are in fact the second-most expensive of the ten companies considered. A comment on Cra-Z-Art – this building block range has just been introduced by LaRose and is currently only at Wal-Mart. An interesting sidenote is that LaRose was founded by Larry Rosen, formerly part-owner and CEO of RoseArt, the company that Mega acquired five years ago and which led to the near-demise of the company.

I also looked at shelf-space over time at Wal-Mart, Target andToysRUs:

Building Blocks shelf space at Wal-Mart, Target and TRU

| |

8/1/2009

|

|

3/12/2010

|

|

9/19/2010 |

|

| |

Feet |

% |

Feet |

% |

Feet |

% |

| Lego |

182 |

65.5 |

805 |

67.25 |

878 |

68.81 |

Mega

|

42 |

19.06 |

214 |

17.88 |

210 |

16.46 |

| Knex |

17 |

4.01 |

88 |

7.35 |

55 |

4.31 |

| Best Lock |

0 |

0.89 |

20 |

1.67 |

15 |

1.18 |

| Lincoln Logs |

1 |

2.34 |

17 |

1.42 |

13 |

1.02 |

| Erector |

0 |

2.68 |

0 |

0.00 |

40 |

3.13 |

| Tinker Toy |

0 |

2.68 |

3 |

0.25 |

0 |

0.00 |

| Trio |

9 |

2.79 |

50 |

4.18 |

58 |

4.55 |

Cra-z-art

|

0 |

0.00 |

0 |

0.00 |

5 |

0.39 |

| CitiBloks |

0 |

0.00 |

0 |

0.00 |

2 |

0.16 |

| Total |

251 |

100.00 |

1197 |

100.00 |

1276 |

100.00 |

Source Klosters Retailer Panel

This suggests that the while the shelf space overall expanded dramatically – undoubtedly driven by the phenomenal growth of the category – Mega’s share in fact marginally declined.

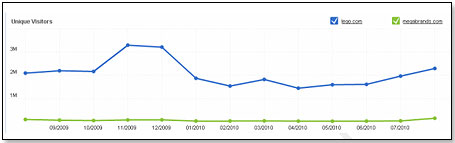

Looking at how Mega fares with the consumer, we are helped by two metrics – web traffic and consumer demographics.

In terms of web traffic, Mega is totally dwarfed by LEGO:

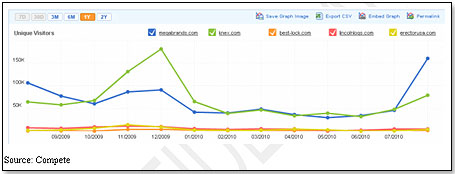

However, the company does well versus its other competitors:

Source: Compete

In terms of demographics, the comparison between the ten brands looks as follows:

| Brand |

Male |

Female |

<18 yrs |

18-24 yrs |

25-34 yrs |

35-49 yrs |

50+ yrs |

| General Population |

49 |

50 |

9.80 |

26.80 |

27.20 |

12.00 |

13.20 |

| Lego |

46 |

54 |

7.92 |

14.25 |

28.20 |

39.54 |

10.09 |

| Mega |

53 |

47 |

16.25 |

18.29 |

23.98 |

21.54 |

19.85 |

| Knex |

38 |

62 |

13.94 |

9.09 |

30.30 |

38.79 |

7.88 |

| Best-Lock |

70 |

30 |

12.18 |

12.96 |

23.15 |

29.15 |

22.55 |

| Lincoln Logs |

41 |

59 |

3.61 |

9.39 |

37.91 |

27.80 |

21.30 |

| Erector |

41 |

59 |

4.55 |

22.73 |

27.27 |

31.82 |

13.64 |

| Tinker Toy |

44 |

56 |

24.91 |

15.41 |

21.09 |

19.92 |

18.67 |

| Trio |

51 |

49 |

23.38 |

22.27 |

16.81 |

19.15 |

18.39 |

Cra-Z-Art

|

41 |

59 |

18.52 |

18.10 |

21.64 |

21.69 |

21.05 |

| Citiblocs |

41 |

59 |

18.77 |

19.48 |

23.15 |

19.38 |

20.22 |

All numbers are in percent – Source Google

When looking at this chart, I assume that the most important factors are gender [female because mothers typically buy the toys for their children], the <18 years group [because they are the influencers], the 25-34 years group [parents] and the 50+ group [grandparents], then Knex and Citi have the best profile. Mega’s profile is decent, with perhaps a male bias.

Overall, the two greatest purchase motivators in the building block space are price and licenses. We looked at the former. As for the latter, there are only three companies actively engaged in the licensing sector: LEGO, Mega and K’nex.

K’nex has two licenses – Sesame Street and Nascar. Neither is movie driven.

The main license battle is between LEGO and Mega. While LEGO has the majority of the movie licenses this and next year, Mega had Iron Man 2 this year and two crackerjack properties next year – Thor and Captain America:

| Producer |

Title

|

Release |

Toy Licensee |

Second Licensee |

Box Office Last Movie

|

Release Date |

Warner

|

Harry Potter Deathly Hallows1 |

11/19/10

|

Tomy/

Neca

|

Lego

|

$294.2 mil |

2009 |

Disney

|

Tangled |

12/1/10 |

Mattel

|

Lego |

None |

None |

Disney

|

Tron Legacy

|

12/17/10

|

Spin-

master

|

Lego |

$33.0 mil |

1982 |

| Universal |

Monster High |

2011

|

Mattel

|

? |

None |

None |

| Warner |

Jack the Giant Killer |

2011 |

? |

? |

? |

1962 |

Disney

|

Beauty and The Beast |

2011 |

Mattel |

? |

$73.6 mil |

1991 |

Marvel

|

Thor

|

5/6/11 |

Hasbro |

Mega

|

None |

None |

| DreamWorks |

Kung Fu Panda

|

6/3/11 |

Mattel |

? |

$206.6 mil |

2008 |

Warner

|

Green Lantern |

6/17/11 |

Mattel

|

Lego |

None |

None |

| Paramount ? ? None None |

TinTin |

8/23/11 |

? |

? |

None |

None |

| Disney |

Cars 2 |

8/24/11 |

Mattel |

Lego |

$220.2 mil

|

2007 |

| Disney |

Pirates of the Caribbean |

7/1/11 |

? |

Lego |

$301.7 mil

|

2007 |

| Hasbro |

Transformers |

7/1/11 |

Hasbro |

? |

$393.7 mil |

2007 |

Warner

|

Harry Potter Deathly Hallows2 |

7/15/11 |

Tomy/

Neca |

Lego |

$294.2 mil

|

2009 |

| Disney |

Winnie the Pooh

|

7/15/11 |

Mattel

|

? |

$17.9 mil |

2005 |

Marvel

|

Captain America

|

7/22/11 |

Hasbro |

Mega |

None |

None |

| Disney |

Smurft |

7/29/11 |

Jakks Pacific |

? |

$11.2 il |

1983 |

| MGM |

The Hobbit |

12/1/11 |

? |

Lego |

$345.3 mil |

2003 |

Note that Box Office sales numbers are U.S. only to end of week 7 after release.

Mega also has the Dragons Universe, Thomas & Friends and Halo licenses. The latter is interesting in that it piggybacks on to the fantastically successful Halo video game franchise.

| “While LEGO has the majority of the movie licenses this and next year, Mega had Iron Man 2 this year and two crackerjack properties next year – Thor and Captain America.” |

As for Mega’s outlook – this is what Michel Bendayan, vice president, Americas Mega Brands Inc., had to say:

“We’re cautiously optimistic based on the traction we’ve been getting with many of our new products and steady growth in our preschool classics. Compared to last year, we have a stronger overall offering in both the Preschool and Boys categories, with a good balance between our own brands and licenses. In Preschool, our Thomas & Friends line was strong coming out of the gate and we believe our design and development team has done a fantastic job of bringing new vitality to this brand. In Boys, we’re really excited with the launch of our new Dragons Universe line while Halo is doing well in all major markets.”

My own take on Mega is that they have indeed turned the corner. I expect them to have a more difficult second half for their toy business than is generally assumed, but they will end the year up versus last year. They continue to have the problem of their declining stationery and activity kit businesses and these will continue to distract management and cost money until they are either sold off or shut down or, somewhat unlikely, turned around.

I am quite bullish for them for next year. Thomas & Friends should have gotten traction by then and their two very strong film licenses — Thor and Captain America — are well timed to provide impetus throughout the year.

Over the longer horizon, I would expect other toy companies to enter this rapidly growing toy segment. Any category that is so overwhelmingly dominated by one brand – e.g. LEGO – is bound to offer opportunities to new product entrants provided these are clearly different from what is now out there. For instance, I have become aware of a very interesting new building block technology developed by Creative Toys under the trade names Swivel-Snaps and Swivel-Blocks that, in the right hands, could well prove a successful new addition to the toy scene.

Writer's Bio: Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author

THIS BANNER IS AN AD:

• • • • • • • • • • • • • • | • • • • • • • • • • • • • • |

Back to TDmonthly's front page

|  |

Advertise on TDmonthly

|