|

Tools:

Disney Makes Defensive Move With Marvel AcquisitionMickey’s Empire Beefs Up Boys’ Market, Preps for International Expansion

| “Disney is very much aware that it is too reliant on the girl segment of the youth audience and that its consumer profile is slanted toward older age groups.” |

September 23, 2009 – The news that Disney was acquiring Marvel hit the entertainment industry like a thunderbolt.

Yes, there had been plenty of rumors about a large Disney acquisition, but the betting by insiders had been on Electronic Arts.  The reason this bet turned out to be wrong was that Disney’s overarching motive was generally misunderstood. Yes, it is true that Marvel represents a good fit, but this is not the fundamental reason. The fundamental reason is that Disney and Time Warner are squaring up against each other and acquiring Marvel was the perfect defensive move. The reason this bet turned out to be wrong was that Disney’s overarching motive was generally misunderstood. Yes, it is true that Marvel represents a good fit, but this is not the fundamental reason. The fundamental reason is that Disney and Time Warner are squaring up against each other and acquiring Marvel was the perfect defensive move.

Disney has been watching the ongoing transformation of Warner, its main competitor in the children’s entertainment field, with increasing concern. By shedding first its cable business, and now getting rid of the AOL stone around its neck, Warner is focusing more on content — films for theaters and television, video products, licenses and consumer products. This puts the company squarely on the road that Disney is traveling.

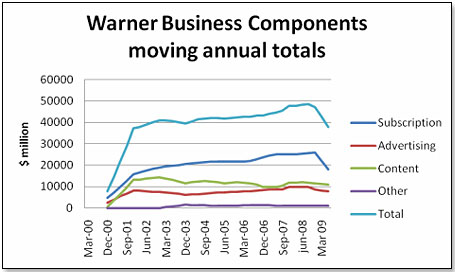

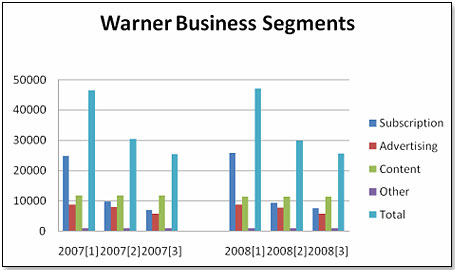

A look at the Warner business tells the story. A sharp decline beginning in 2008 shows how the divestment of the cable business affects Warner’s business mix:

The picture becomes even clearer if we back out the AOL component as well:

Content, e.g. films, etc., is hence becoming the preponderant part of Warner’s business mix, putting it in direct opposition with Disney.

A look at film offerings from the two tells the story:

| Producer |

Film |

Release Date |

Focus |

Film Weight* |

| Warner |

Harry Potter and the Half-Blood Prince |

07/15/2009 |

Boy |

10 |

| Warner |

Where the Wild Things Are |

10/16/2009 |

Boy |

7 |

| Disney |

A Christmas Carol |

11/06/2009 |

Girl/Boy |

5 |

| Disney |

The Princess and the Frog |

12/11/2009 |

Girl |

8 |

| Disney |

Alice in Wonderland |

03/05/2010 |

Girl |

8 |

| Disney |

Prince of Persia: The Sands of Time |

05/28/2010 |

Girl/Boy |

5 |

| Disney |

Toy Story 3 |

06/18/2010 |

Girl/Boy |

9 |

| Warner |

Harry Potter and the Deathly Hollows: Part 1 |

11/19/2010 |

Boy |

10 |

| Disney |

Tron |

12/10/2010 |

Girl/Boy |

5 |

| Warner |

Green Lantern |

12/17/2010 |

Boy |

9 |

| Disney |

Rapunzel |

12/01/2010 |

Girl |

6 |

| Disney |

Cars 2 |

07/01/2011 |

Boy |

10 |

| Warner |

Harry Potter and the Deathly Hollows: Part 2 |

07/15/2011 |

Boy |

10 |

| Warner |

Batman |

06/30/2012 |

Boy |

10 |

*as per toy buyers: 10 best, 1 worst

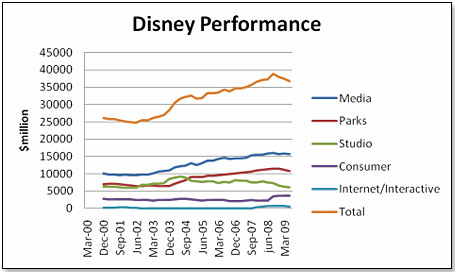

In short, Warner has better offerings and a much stronger boy bias. Therein lies the rub. Disney is very much aware that it is too reliant on the girl segment of the youth audience and that its consumer profile is slanted toward older age groups. Also, Disney is aware that its core business [consumer, studio and Internet] has been stagnant to declining as of late:

DISNEY

Gender: Female-oriented, with the following confidence:

:0.36 :0.36  :0.64 :0.64

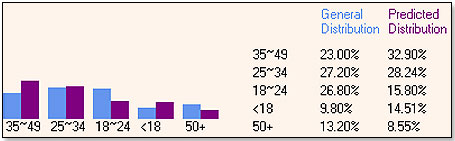

Age: 35-49 Oriented with following distribution:

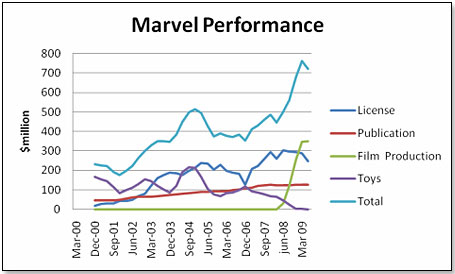

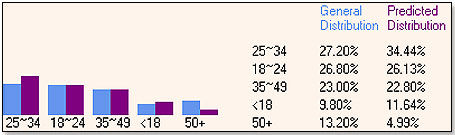

This is where Marvel comes in. Marvel is growing, Marvel has a boy bias, and Marvel has a much younger core audience:

MARVEL

Gender: Male-oriented, with the following confidence:

:0.66 :0.66  :0.34 :0.34

Age: 25~34 Oriented with following distribution:

Looking at Marvel’s film offerings, it appears the company can more than offset Disney’s relative weakness vis-à-vis Warner:

| Producer |

Film |

Release Date |

Focus |

Film Weight* |

| Marvel |

X-Men Origins: Wolverine |

05/01/2009 |

Boy |

5 |

| Marvel |

Iron Man 2 |

05/07/2010 |

Boy |

7 |

| Sony |

Spiderman 4 |

05/06/2011 |

Boy |

10 |

| Marvel |

Thor |

05/20/2011 |

Boy |

9 |

| Marvel |

Captain America |

07/22/2011 |

Boy |

9 |

| Marvel |

The Avengers |

05/04/2012 |

Boy |

9 |

| Marvel |

Iron Man 3 |

05/01/2013 |

Boy |

9 |

*as per the toy buyers: 10 best, 1 worst

There are, in addition, an incredible number of unexploited brands that will allow Disney to freshen its offerings in all its major areas: films, parks, television programs and consumer product licenses. Of the 5,000 characters in Marvel’s portfolio, only about 20 have ever been used in films or other entertainment channels. The same statement applies to video games, and the recent acquisition of Wideload by Disney demonstrates its willingness to sharpen its focus in that area. There are, in addition, an incredible number of unexploited brands that will allow Disney to freshen its offerings in all its major areas: films, parks, television programs and consumer product licenses. Of the 5,000 characters in Marvel’s portfolio, only about 20 have ever been used in films or other entertainment channels. The same statement applies to video games, and the recent acquisition of Wideload by Disney demonstrates its willingness to sharpen its focus in that area.

Lastly, Disney has and will gain international strength. Disney has innumerable operations around the globe, on all continents, and a quarter of its revenue, $9.3 billion, comes from areas outside the United States. In comparison, Marvel has about one-third of its business, about $233 million, outside the United States. There is little doubt that Disney will be able to significantly strengthen and accelerate Marvel’s exposure and revenue there.

As for future direction, one strategy seems clear — Disney will abide by and respect all Marvel licensing agreements in place unless there are very strong commercial and legal reasons for terminating these prematurely. For instance, Disney was aware of and approved the recently negotiated extension of the Hasbro toy master license to 2017. It seems equally clear that most of these licenses, once matured, will be clawed back and re-assigned by Disney. As for future direction, one strategy seems clear — Disney will abide by and respect all Marvel licensing agreements in place unless there are very strong commercial and legal reasons for terminating these prematurely. For instance, Disney was aware of and approved the recently negotiated extension of the Hasbro toy master license to 2017. It seems equally clear that most of these licenses, once matured, will be clawed back and re-assigned by Disney.

The question most onlookers are asking is whether two companies of such disparate size and culture can possibly coexist under one roof. Marvel under Perlmutter as CEO was entrepreneurial, results-driven and totally focused on the bottom line. Disney is — being so much larger — a much more structured and hierarchical company where adherence to company discipline and teamwork is valued ahead of monetary success (even though monetary success is also important).

There are two models Disney can follow in its incorporation of Marvel:

1. One is Miramax, which, after a short honeymoon, shed its original owners and was totally integrated into and submerged by Disney.

2. The other is Pixar, which, under the leadership of Steve Jobs, pretty much retained its independence — underpinned by the fact that Jobs was and is not only the largest single Disney shareholder but is also on the Disney board of directors. My sources tell me that Perlmutter, who will be the second largest Disney shareholder after Jobs, will have a seat on the Disney board, will report directly to Disney CEO Robert Iger, and will continue to run Marvel pretty much as a separate entity.

Whatever happens, the success or failure of Disney’s integration of Marvel will heavily influence the degree of competitive strength Disney can muster against Warner.

Writer's Bio: Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author

THIS BANNER IS AN AD:

• • • • • • • • • • • • • • • • | • • • • • • • • • • • • • • • |

Back to TDmonthly's front page

|  |

Advertise on TDmonthly

|