| “… the question is really whether Mega is strong enough to overcome its exposed premium-priced position between an immovable Lego and an unstoppable Trio.” |

At Toy Fair 2009, Fisher-Price presented an exciting new entry into the construction toy category:  Trio. This fills a major gap in Mattel’s portfolio and the products have just hit the shelves. What does Trio’s introduction mean for its competitors – Lego, Mega Brands, K’Nex and Best-Lock?

Trio. This fills a major gap in Mattel’s portfolio and the products have just hit the shelves. What does Trio’s introduction mean for its competitors – Lego, Mega Brands, K’Nex and Best-Lock?

As of July 25, this is how the five brands looked in terms of distribution:

| Retailer |

Lego |

Mega Brands |

K'Nex |

Best-Lock |

F-P Trio |

|

Wal-Mart

on shelf

|

101

|

2*

|

2

|

0

|

0

|

|

Wal-Mart

online only

|

71

|

3

|

13

|

0

|

0

|

|

Target

on shelf

|

51

|

8**

|

14

|

0

|

0

|

|

Target

online only

|

84

|

30

|

6

|

0

|

0

|

|

Toys “R” Us

on shelf

|

231

|

72

|

37

|

12

|

15

|

|

Toys “R” Us

online only

|

3

|

0

|

0

|

0

|

0

|

|

Total SKUs

|

541

|

115

|

72

|

12

|

15

|

*plus 3 on clearance **plus 1 on clearance

I also looked at shelf space of the various brands on July 25. Note: A single shelf represents 4 feet:

| Shelf Space (feet) |

Wal-Mart* |

Target |

Toys “R” Us |

Total |

| Lego |

76 |

120 |

392 |

588 |

|

Mega Brands

|

5 |

5 |

161 |

171 |

| K'Nex |

2 |

7 |

27 |

36 |

| Best-Lock |

|

|

8 |

8 |

| Lincoln Logs |

3 |

|

18 |

21 |

| Erector |

|

|

24 |

24 |

| Tinker Toy |

|

|

24 |

24 |

| Trio |

0 |

0 |

25 |

25 |

| |

86 |

132 |

679 |

897 |

| Shelf Space (%) |

Wal-Mart* |

Target |

Toys “R” Us |

Total |

| Lego |

88.4 |

90.9 |

57.7 |

65.6 |

|

Mega Brands

|

5.8 |

3.8 |

23.7 |

19.1 |

| K'Nex |

2.3 |

5.3 |

4.0 |

4.0 |

| Best-Lock |

0.0 |

0.0 |

1.2 |

0.9 |

| Lincoln Logs |

3.5 |

0.0 |

2.7 |

2.3 |

| Erector |

0.0 |

0.0 |

3.5 |

2.7 |

| Tinker Toy |

0.0 |

0.0 |

3.5 |

2.7 |

| Trio |

0.0 |

0.0 |

3.7 |

2.8 |

| |

100.0 |

100.0 |

100.0 |

100.0 |

At this point in time, Trio has only made it into Toys “R” Us. However, it is my understanding that both Wal-Mart and Target will take the brand on to their shelves before the fourth quarter.

Lego clearly dominates, and Mega Brands occupies the second position. K’Nex is the only other brand present at all three; the others are more sporadic.

It is also informational to look at pricing:

| Maker |

Product |

Pieces |

Retail $/Pack |

Retail $/Piece |

Made in |

| Best-Lock |

War Planets |

105 |

6.99 |

0.07 |

China |

| Best-Lock |

Military |

240 |

10.99 |

0.05 |

China |

| Fisher-Price |

Trio-Watch Tower |

64 |

14.99 |

0.23 |

China |

| Fisher-Price |

Trio - King's Gate House |

79 |

24.99 |

0.32 |

China |

| Fisher-Price |

Trio - Fire Station |

91 |

24.99 |

0.27 |

China |

| Fisher-Price |

Trio - Wizard's Castle |

150 |

39.99 |

0.27 |

China |

| Fisher-Price |

Trio - King's Castle |

214 |

74.99 |

0.35 |

China |

| K'Nex |

City Rider |

128 |

5.99 |

0.05 |

USA/China |

| K'Nex |

Tractors and Trucks |

138 |

10.99 |

0.08 |

USA/China |

| K'Nex |

Racers |

411 |

20.99 |

0.05 |

USA/China |

| K'Nex |

Blocks |

551 |

30.99 |

0.06 |

USA/China |

| Lego |

Duplo |

32 |

29.99 |

0.94 |

Europe |

| Lego |

Creator |

193 |

14.99 |

0.08 |

Europe |

| Lego |

Castle |

335 |

40.99 |

0.12 |

Europe |

| Lego |

Agents |

340 |

40.99 |

0.12 |

Europe |

| Lego |

City |

953 |

99.99 |

0.10 |

Europe |

| Mega Brands |

Ni Hau Kai Lan |

30 |

20.99 |

0.70 |

Canada |

| Mega Brands |

Mickey Mouse Club |

48 |

29.99 |

0.62 |

Canada |

| Mega Brands |

Fun Activities |

80 |

19.95 |

0.25 |

Canada |

| Mega Brands |

CARS |

95 |

39.99 |

0.42 |

Canada |

| Mega Brands |

Mini |

250 |

24.99 |

0.10 |

Canada |

| Mega Brands |

King Arthur |

450 |

20.99 |

0.05 |

Canada |

Mega Brands and Lego are approximately on the same premium-priced level with Trio, whereas K’Nex and Best-Lock are significantly more economical.

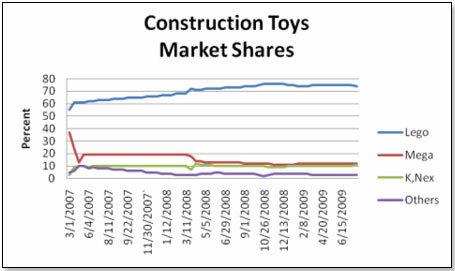

I have been tracking construction toy market shares in the United States for more than two years, on the basis of the sell-through numbers provided by my retailer panel, and the chart looks as follows:

Note that Mega Brands’ product recalls took place on March 31, 2006, April 19, 2007, and March 17, 2008.

As a sanity check, I took a snap shot of the situation on July 15, and this is what I found in terms of market share:

| Retailer |

Total Positions |

Brand |

Brand Positions |

Brand Weight |

Brand Weight % |

| Amazon |

100

|

Lego

|

76

|

4008

|

95.4

|

|

|

|

Mega Brands

|

2

|

101

|

2.4

|

|

|

|

K'Nex

|

2

|

89

|

2.1

|

|

|

|

Best-Lock

|

0

|

0

|

0.0

|

|

Toys "R" Us

|

13

|

Lego

|

6

|

52

|

74.3

|

|

|

|

Mega Brands

|

1

|

9

|

12.9

|

|

|

|

K'Nex

|

3

|

19

|

27.1

|

|

|

|

Best-Lock

|

*

|

*

|

*

|

|

Retailer Panel

|

40

|

Lego

|

75

|

613

|

74.8

|

|

|

|

Mega Brands

|

5

|

114

|

13.9

|

|

|

|

K'Nex

|

3

|

92

|

11.2

|

|

|

|

Best-Lock

|

*

|

*

|

*

|

*less than 1 percent

As for my methodology: At Amazon, I looked at the relative position of each product within the top 100 products and assigned a weight to each position. Lego clearly dominates, as it does also at Toys “R” Us (where I followed the same methodology). My own retailer panel of 10 doors measures sell-through and again, here we have Lego in a clearly dominating position.

In all three, Mega Brands and K’Nex are very closely matched.

Given this competitive constellation facing Trio, the question is not whether the brand will establish itself but rather at whose expense it is likely to do so.

It is my sense, supported by the view of my retail panel managers, that there are two very basic motivators driving consumers to select one toy brand versus another: price and brand adherence. The presence of licenses is likely to lend additional weight to either of the two underlying drivers. Quality is a non-issue in this particular instance, in that all construction toy brands are seen as very good products. There is still the cloud of recall history besetting both Mega Brands and Fisher-Price, which is likely to continue to resonate with some consumers. But I would not consider this a major or decisive issue at this juncture.

There is little doubt that Lego wins in the branding stakes. The 12th annual Top 500 Superbrands survey, which identifies the UK’s strongest consumer brands by polling the British public, published its 2009 findings on July 15. The highest placed leisure and entertainment brand was Lego, making it No. 8, followed by Nintendo at No. 20, Fisher-Price at No. 24 and Disney at No. 30. This position is further enhanced by the stable of very powerful licenses granted to the company — Harry Potter, Star Wars, Transformers, Indiana Jones and Disney.

There is little doubt that Lego wins in the branding stakes. The 12th annual Top 500 Superbrands survey, which identifies the UK’s strongest consumer brands by polling the British public, published its 2009 findings on July 15. The highest placed leisure and entertainment brand was Lego, making it No. 8, followed by Nintendo at No. 20, Fisher-Price at No. 24 and Disney at No. 30. This position is further enhanced by the stable of very powerful licenses granted to the company — Harry Potter, Star Wars, Transformers, Indiana Jones and Disney.

While Lego’s dominant market share would make it a natural target for Fisher-Price, I doubt whether it will get very far, at least in the short term. Lego is simply too strong. Lego may lose some shelf space to Trio, as it seems to have already done at Toys “R” Us, but I do not see a significant erosion of market share, at least this year. It is much more likely that one of the lesser brands will face the initial brunt of the onslaught, and it is the objective of this article to determine who the likely victim is going to be. To do so, I have asked the management of Mega Brands, K’Nex and Best-Lock for their opinions, with particular focus on what they think makes their brands unique. Mega Brands elected not to respond.

K’Nex: Michael Araten, president and CEO:

“I see too many businesses using the economy as an excuse for poor performance. Ultimately, the best products brought to market with great value win the day. K’NEX is simply the best combination of quality and value in the construction toy aisle. Consumers want brands they know and trust today more than ever. We have made sure that over 70 percent of our line will be at retails that are under $30, with a large selection of building sets in many themes. Like millions of parents around the world, my wife and I are pressed for time and shopping has to be easy. When we looked at the construction toy aisle, we saw (and still see) a unique way to make parents’ lives a little bit easier. K’NEX has a “1 second rule” for packaging. In the one second that Mom or Dad is walking down the aisle, our package has to communicate what their child can build, that the experience will be fun and cool, and how old the child should be to have building success. In my opinion, no one else does that better than us.”

There’s a very clear message here: price, value and merchandising.

Best-Lock Construction Toys: Stephen Minsk, VP Global Sales:

“Clearly the overall economy is tough world wide and no one can really say when we will see the end of the economic issues specifically when the key indicators will turn around. In this environment it is clear to me that people are looking for value for their hard-earned money. Best-Lock products are different from our competitors in a number of ways. Some clear and others more subtle. We have unique themes, of course, and some licensed properties, so they are clear differences. We build value into each and every set, and a big element of that is, each and every product is a true building set.We do not offer large pre-built molded pieces with a few blocks to add and call that a construction toy as some of our competitors tend to do.”

Again here, the concept is clearly enunciated: value, price and product differentiation.

Since Mega Brands did not respond, I will attempt to put forth a set of competitive highlights for the company. One of these is price. Unlike K’Nex and Best-Lock, Mega is priced much higher per unit, and the difference is significant. In fact, the price profile is very similar to that of Lego and Trio. A negative is that the brand can clearly not compete with either Lego or Fisher-Price in terms of brand recognition or loyalty. In other words, it is missing competitive strength in terms of both basic drivers defined further above — price and consumer adherence.

While we can assume that the effects of the three recalls have faded, the brand has clearly not recovered its former market share, which, at one time, rivaled that of Lego. Mega management is trying its utmost to overcome these weaknesses by buttressing the brand with aspects designed to strengthen overall product attributes. One of its 2009 products — the Battle Striker Tournament Set — just made Hamley’s list of top-10 Christmas toys. Hamley’s is a small but respected UK retailer with a profile similar to FAO Schwartz in the U.S., with eight stores in the UK and another six elsewhere: Denmark (3), Ireland (1), Jordan (1) and Dubai (1). So far, the Battle Striker set has not made it to Wal-Mart or Toys “R” Us, and only to Target online, but this will undoubtedly change as Mega’s PR effort for the product gets traction.

While we can assume that the effects of the three recalls have faded, the brand has clearly not recovered its former market share, which, at one time, rivaled that of Lego. Mega management is trying its utmost to overcome these weaknesses by buttressing the brand with aspects designed to strengthen overall product attributes. One of its 2009 products — the Battle Striker Tournament Set — just made Hamley’s list of top-10 Christmas toys. Hamley’s is a small but respected UK retailer with a profile similar to FAO Schwartz in the U.S., with eight stores in the UK and another six elsewhere: Denmark (3), Ireland (1), Jordan (1) and Dubai (1). So far, the Battle Striker set has not made it to Wal-Mart or Toys “R” Us, and only to Target online, but this will undoubtedly change as Mega’s PR effort for the product gets traction.

More important are the licenses Mega has recently obtained to offset those it lost to Lego. One of them is Halo, based on the fantastically successful video game. Mega has already shipped products based on the Halo license and I saw two SKUs at Toys “R” Us on July 25. It is too early to say how sales will develop, but there is some question as to how easily the consumer following of this “mature” rated video game, mainly bought by teenagers and post-teen males, can be migrated to mothers of preschoolers.

In addition, Mega has captured the Thomas & Friends license for the construction category, effective 2010. This license has good potential, but whether it can, without major media investment, stand up to Lego’s Harry Potter and other film-backed licenses next year is a major question mark.

While these are all steps in the right direction, the question is really whether Mega is strong enough to overcome its exposed premium-priced position between an immovable Lego and an unstoppable Trio. K’Nex and Best-Lock have very clear product and price attributes that offer the economy minded consumer a real choice; Mega’s proposition is less focused and hence more vulnerable.