|

Tools:

Have Virtual Playgrounds Played Out?Traffic Patterns and Web Indicators Show a Stagnant Market

| “… the growth of the virtual playground concept has, at least in the United States, slowed in terms of traffic and interest.” |

August 21, 2008 – At the beginning of the year, I said in my article “Is All This Talk About Webkinz Good?” that the top six virtual playgrounds were beginning to face challenges. I decided to revisit these six and look at four additional virtual playgrounds, resulting in the following 10 sites: August 21, 2008 – At the beginning of the year, I said in my article “Is All This Talk About Webkinz Good?” that the top six virtual playgrounds were beginning to face challenges. I decided to revisit these six and look at four additional virtual playgrounds, resulting in the following 10 sites:

This listing does not include Hasbro’s Littlest Petshop VIP website, which launched in October 2007. As it is part of the Hasbro website, not a stand-alone domain, it is not possible to isolate its traffic from that of Hasbro overall. In its second-quarter webcast, Hasbro management mentioned that the VIP site had nearly 2 million adoptions since its release. This is not too disappointing, since Webkinz has about 11 million subscribers and Barbie Girls claims about the same number. Reaching nearly 2 million subscribers in less than a year is a good achievement. This listing does not include Hasbro’s Littlest Petshop VIP website, which launched in October 2007. As it is part of the Hasbro website, not a stand-alone domain, it is not possible to isolate its traffic from that of Hasbro overall. In its second-quarter webcast, Hasbro management mentioned that the VIP site had nearly 2 million adoptions since its release. This is not too disappointing, since Webkinz has about 11 million subscribers and Barbie Girls claims about the same number. Reaching nearly 2 million subscribers in less than a year is a good achievement.

Another interesting newcomer is Kookeys.com, which was launched by 10VOX in 2007 but adapted into a 3D version just recently, on Aug. 2. The product range does not register on any of the Web screens, but I understand that it started well and that Ganz considers it a real threat to its Webkinz. Kookeys are similar to Webkinz but larger in size, retailing between $7 and $14.99. The line’s 19 plush SKUs are sold at Target online and otherwise entirely in specialty stores. At this point, neither Toys “R” Us nor Wal-Mart is carrying the range.

WEB TRAFFIC COMPARATIVES

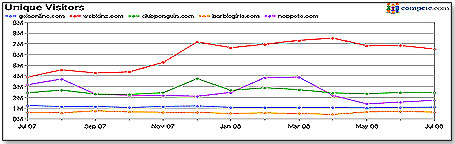

As the virtual playgrounds are totally web-dependent, it seems reasonable to look at their Web traffic first. I am presenting this in two groups.

The first group:

Traffic performance year-on-year and for the month looks as follows:

| Website |

Unique Visitors

July 2008 |

12-month % Change

2008 vs. 2007 |

% Change July 2008

vs, June 2008 |

| Webkinz.com |

6,496,000 |

+ 67.6% |

- 4.8% |

| Clubpenguin.com |

2,427,000 |

+ 0.8% |

- 0.5% |

| Neopets.com |

1,707,000 |

- 46.0% |

+ 0.4% |

| Gaiaonline.com |

1,074,000 |

- 11.8% |

+ 1.7% |

| Barbiegirls.com |

597,000 |

+ 3.5% |

- 13.5% |

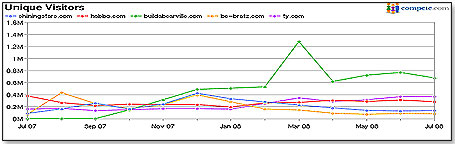

And the second group:

Traffic performance year-on-year and for the month looks as follows:

| Website |

Unique Visitors

July 2008 |

12-month % Change

2008 vs. 2007 |

% Change July 2008

vs, June 2008 |

| Buildabearville.com |

674,000 |

n/a |

- 12.1% |

| Ty.com* |

364,000 |

+ 132.4% |

- 0.3% |

| Habbo.com |

281,000 |

- 8.8% |

- 25.3% |

| Shiningstars.com |

133,000 |

+ 55.7% |

+ 6.4% |

| Be-Bratz.com |

79,000 |

n/a |

- 6.7% |

*Note that Ty.com includes both Beanie-babies.ty.com as well as Ty.girlz.ty.com.

The only website that shows positive growth for both comparatives is Shiningstars.com. All others in the overall tend to stagnate or decline.

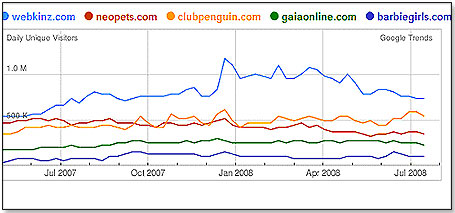

INTEREST BY NON-USERS

While the web traffic above takes a snapshot of the behavior of existing website users, it is also interesting to see what people do who are not yet familiar with the site but are trying to access it. Google has recorded the following searches for the top five brands over the past 12 months worldwide:

What this basically shows is consumer interest to the degree that they are trying to find the website. With the exception of Club Penguin, which shows a marginally positive tendency, the other four are clearly stagnant or declining.

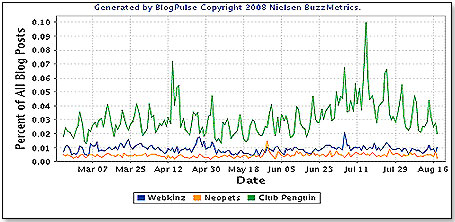

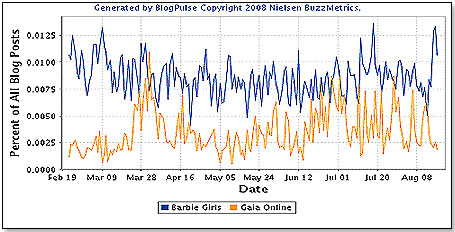

BLOG METRICS

Blog Metrics measure the incidence in which a product is discussed on the Web. This can demonstrate both positives [increased interest] as well as negatives [criticism]. A recall would, for instance, engender the latter.

As for the first three brands:

After a run-up since April, Club Penguin has begun to show a sharp decline. The other two are fairly

stagnant..

As for the next two websites, Gaia Online and Barbie Girls:

Gaia Online seems to have moved upward between February and June but has stagnated since. Barbie Girls seem to be treading water.

WHAT DOES IT MEAN?

On the basis of all these metrics, I must conclude that the growth of the virtual playground concept has, at least in the United States, slowed in terms of traffic and interest. That is at least anecdotally supported by the reports received from retailers that Webkinz sales have declined fairly significantly since the beginning of the year [though they’re still beating other plush overall]. Also, judging from a recent quarterly report, the same seems to have happened to Shining Stars of Russ Berrie. On Aug.19, Russ’ CEO said in reference to Shining Stars that “sales have slowed significantly year-to-date.” On the basis of all these metrics, I must conclude that the growth of the virtual playground concept has, at least in the United States, slowed in terms of traffic and interest. That is at least anecdotally supported by the reports received from retailers that Webkinz sales have declined fairly significantly since the beginning of the year [though they’re still beating other plush overall]. Also, judging from a recent quarterly report, the same seems to have happened to Shining Stars of Russ Berrie. On Aug.19, Russ’ CEO said in reference to Shining Stars that “sales have slowed significantly year-to-date.”

Both large and small toy retailers were and continue to be very concerned about the trend to virtual playgrounds, for obvious reasons. However, research suggests that this threat to their business is, in fact, beginning to decline.

Writer's Bio: Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author

THIS BANNER IS AN AD:

• • • • • • • • • • • • • • • • • • • | • • • • • • • • • • • • • • • • • • • |

Back to TDmonthly's front page

|  |

Advertise on TDmonthly

|