|

Tools:

The Chinese Toy Market – Monumental Opportunities, Gigantic Challenges

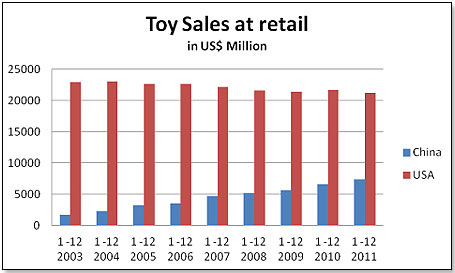

We all know that China is making pretty much all the toys the rest of the world buys, but few realize that China is also a major toy market in its own right. Equally significant, China today is probably the fastest growing major toy market in the world. This is what the numbers look like in comparison to the United States:

I set out to look at the Chinese domestic toy market through the prism of a North American or European toy manufacturer who is not yet established in China but who would like to take advantage of the opportunities existing there.

To get the insights of the people who are in the thick of things, I turned to two acknowledged insiders – Alex Chan, COO of Blue Box and in charge of the company’s Chinese business, and Henry Hu, owner of Business Plus Consultants Limited, a company located in Hong Kong that assists foreign companies in breaking into the Chinese toy market. Both gentlemen are extremely knowledgeable of the intricacies and the challenges that characterize the Chinese domestic marketplace for toys. I also picked the brains of my friends at the large third-party manufacturers for Hasbro and others.

These challenges are best described by focusing on four key issues: understanding cultural differences, deciding on importation or domestic manufacture, establishing distribution in China, and safeguarding against knock-offs.

Cultural Differences

Chinese history and traditions span the millennia and this is reflected in their customs, their way of doing business, and – yes – in their perception of toys. For a foreigner this can at times be extremely confusing. The best example is Barbie’s six-story Palace in Shanghai that was closed after a mere two years. Why? The Chinese mothers simply did not think that Barbie was a good role model for their daughters. Firstly, Barbie did not look Chinese. Secondly, Chinese are quite puritanical and Barbie did not live up to their pretty rigid standards in terms of its dress and body development.

Another example for this is the virtual absence of electronic learning products on the Chinese domestic market - at least until now. The main reason is that western educational systems favor lateral thinking and the striving for top grades rather than knowledge for its own sake, whereas the Chinese system concentrates on memorization as a major driver of its learning program. And since the Chinese writing system has nearly 50,000 characters, this method makes eminent sense. It also leads to a kind of "democracy" of learning, whereby pupils of all abilities reach goals together. In the Western system, devoted to getting top grades over any other consideration, less bright students tend to be left behind.

One company that recognizes these differences is VTech, a Hong Kong based company making electronic learning products such as the Innotab and Mobigo. They are fully aware of the fact that China is a potentially huge market place for those that find the right entry point. To do so companies will, per VTech, require some changes to their mainly Western model. "In the U.S., fun and learning go well together," says Allan Wong, VTech’s Chairman. "Most products are 50 percent fun, 50 percent learning." In China, though, the ratio is more 95 percent learning, 5 percent fun. With that in mind, Allan Wong has formed partnerships with Chinese textbook publishers so that the VTech offering can seamlessly complement school lessons on the pre-school, kindergarten and early primary levels.

In summary, one should never ever assume that a product is right for the Chinese market even though it does well everywhere else. A relatively small investment in consumer research may well prevent much larger expenses further down the pike – remember Barbie and her Shanghai Palace.

Deciding on Importation or Domestic Manufacture

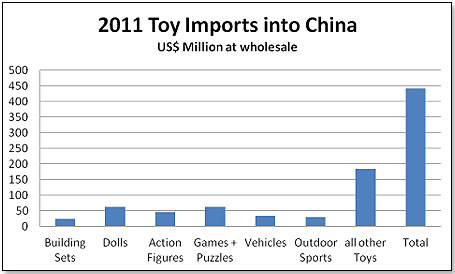

Only 6% of Chinese toys are imported – 94% are made in China. Toy imports in 2011 at wholesale prices amounted to a mere $440 million:

Source; China Toy and Juvenile Products Association

Lego’s CEO recently said that the Chinese toy market represented less than 1% of the company’s worldwide sales of some US$ 3 billion. Similarly, Mattel and Hasbro, the two largest toy companies in the world, have a very small footprint in the domestic Chinese toy market even though they produce pretty much every product of theirs in Chinese factories.

There are benefits and disadvantages to importing finished toys into China. One benefit is that you keep total control over the manufacturing process – which is not necessarily always the case with products made in third-party Chinese factories. It also allows you to market test a product relatively cheaply.

The disadvantages are pretty obvious. Firstly, your pricing will be higher than if you produced in China. Secondly, you will probably be restricted to the few international retailers that have operations in China – ToysRUs with 30 stores, Carrefour with 203 and King Jouet with 8 stores. Wal-Mart has 370 stores, but getting your imported product onto their shelves will be virtually impossible. Thirdly, you will still have to use Chinese packaging, Chinese-language inserts, etc. Other than for conducting a market test, there is no benefit in importing finished toys into China.

There is another alternative to using brick-and-mortar stores for your imported product. Henry Hu tells me that "China has one of the world's highest online sales versus retail ratio. Some 300 million online consumers and as much 30% of sales can be online sales driven." This, of course, has its own pitfalls and challenges, including the cost of establishing and promoting your eCommerce website. But it might be the one way by which you can keep control over your product.

However, after all is said and done, there is really no alternative to producing toys in China if one wants to be a factor in that market. The only question is when and with which factory to take the plunge – and this is a step to be taken with extreme caution. There are a bout 100,000 toy factories in China today and while many are in all respects on par with or superior to the factories in the West, many others are everything but.

Establishing Distribution in China

Establishing distribution in China can be a major challenge in that the supply chain for toys in this vast land is totally convoluted. There is not one organization that covers the entire country, even though several claim to do so. At best, a distributor or wholesaler covers several provinces out of the total of thirty-six (not counting the Province of Taiwan).

The total population of about 1.3 billion lives on over 3.7 million square miles, which includes more than 600 cities with more than 1 million inhabitants each, which in turn are separated by huge tracts of rural countryside. To further complicate matters, the typical Chinese wholesaler network is comprised of several levels of third parties – all selling down the pyramid to finally reach the consumer – and all these participants want to make money. Also, the further one gets away from the peak of the pyramid – namely you – the less you know what really happens to the product and where it is finally bought at what price.

The first decision one needs to make in relation to one’s distribution is where the product is to be sold. According to Alex Chan of Blue Box, "There are larger distributors and wholesalers for 1st tier cities and sub-distributors and sub-wholesalers for 2nd tier and 3rd tier cities."

There is no formal definition of what constitutes a "first-tier," "second-tier" or "third-tier" city in China. However, it is commonly agreed that the top tier incorporates Shanghai and Beijing, as well as Guangzhou and Shenzhen, well-off cities just across the border from Hong Kong and at the heart of the industrial Pearl River Delta.

That’s thanks not only to their large size but also the fact that they have the highest incomes in the country. But they account for only 9 percent of the country’s population. There are many more people living in the Tier Two cities, often defined as the provincial capitals and special administrative cities — 23 in all.

Even though competition for shelf space in the first-tier cities is extreme and selling there costly, it is probably the best place for any newcomer to begin for a number of reasons.

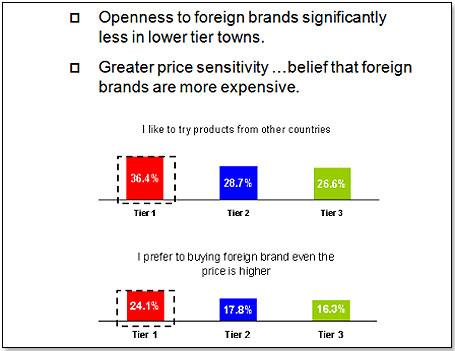

Firstly, the foreign retailers are there and so are the very large and very sophisticated Chinese department stores. Secondly, you can cover them by working with one or two Chinese distribution companies, and hence you can exert at least some sort of control over what happens with your product on its way to the consumer. Thirdly, the consumers are more likely to go for the brand rather than just the price. And lastly, the Tier 1 consumer is more relaxed about buying foreign products than her sisters in lower-tier cities [chart courtesy Ogilvy Mather]:

The second decision is with whom to partner and this is where I would strongly urge thorough research and the help of trusted local sources. Finally, one should never enter into a business arrangement without having met the principals, walked the factory, and established a personal relationship.

Safeguarding Against Knock-Offs

These continue to be a significant problem in China. To give an example, building blocks are one of the most popular toys in the Chinese market, yet Lego has virtually no business there. On the other hand, Ali Baba features more than 100 manufacturers who offer "Lego" products, or "Lego-like" products. Considering that the Lego Corporation is one of the fiercest defenders of its intellectual property and has the muscle to fight these wars, this situation speaks volumes.

However, Henry Hu has a more optimistic view: "China has demonstrated more and more its commitment to the enforcement and implementation of the copyright, trademark, and patent laws since their entry into WTO. Knock-offs are still there but it is possible and feasible to fight them under the protection of the law of the land. The Chinese authority regulatory agencies are effectively dealing with infringement cases. The smaller company may encounter difficulties because of the legal expense, particularly if interlocutory injunctions are required. The China courts also sometimes may be more lenient toward Chinese defendants (particularly if they are connected to powerful groups). Generally, the larger international law firms present in China are most likely the best choice in such a case even though the bills may be steeper."

Alex Chan has a different take on this: "I'm afraid there is very little one can do at the moment. Still, you are recommended to have your properties trademarked, design registered, or patented in China". He adds that the "larger wholesalers are beginning to reject knock- off products".

In addition to taking the normal legal precautions mentioned by Alex, one of my friends suggests that it may be advisable to set up a wholly owned foreign company to supervise the third-party manufacturing process rather than entering into a joint venture, because this provides tighter control over access to the technology and know-how. Separating the production into three or more operations located with different manufacturers can prevent any outsider from seeing the whole process. Another good way to prevent technology diversion is to make components crucial to the process in-house, rather than outsourcing them.

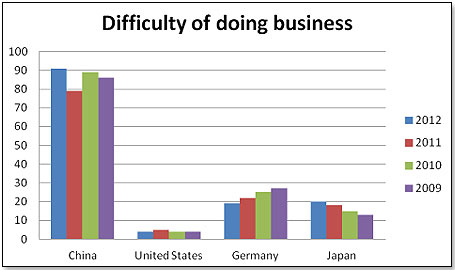

These four challenges are the main reason why the Chinese business climate is rated as very difficult according to the World Bank:

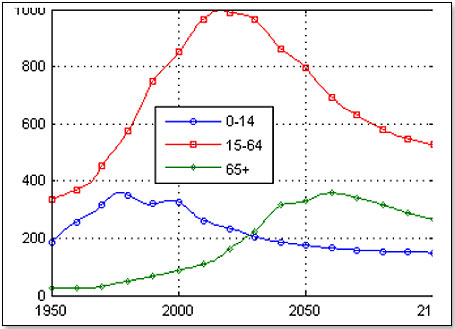

There is every reason to assume that the Chinese toy market will become more accessible and less difficult as time goes by. However, time is also the enemy. The main threat to the Chinese toy market is rooted in the country’s one-child policy introduced in 1978. This is what it did to China’s population, according to the United Nations Department of Economic and Social Affairs:

The number of children below 15 years old has markedly declined since then and today is one quarter below the 1978 peak. Equally ominously, the trend does not show any signs of stopping anytime soon – between now and 2100, another drop of 40% is likely. And demographic trends are somewhat similar to glaciers – they move very slowly but inexorably and resist all efforts to change them in the short term. Even if the Chinese government were to totally reverse course on this today, you would not see a turn-around much before 2050.

Looking at it through the prism of the toy market – there is today an incredible amount of untapped potential and a promise for rapid and sustained market growth over the next decade or so as access improves and market penetration proceeds from Tier 1 to Tier 2 and Tier 3. However, the overall potential is on a downward course because of the drop in the population of children, and this will eventually result in an over saturated market and then in a declining one. It is probable that only the manufacturers with the strongest brands and the best price/quality profile will have a good chance for profitable survival at that point.

In other words – if you want to get into China, there is probably no better moment than today.

Writer's Bio: Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author

THIS BANNER IS AN AD:

• • • • • • • • • • • • • • • • | • • • • • • • • • • • • • • • • |

Back to TDmonthly's front page

|  |

Advertise on TDmonthly

|